financial exclusion and the role of islamic finance in australia a ca by mohamed rosli mohamed sain mohammad m rahman et al

It is thus incumbent upon Muslims to find a way of lending, borrowing, and investing without interest. Islam is not the only religious tradition to have raised serious concerns about the ethics of interest, but Muslims have continued to debate the issue with vigour. The head of local Islamic finance company Amanah Finance explains that the core philosophy goes further than avoiding interest.

We offer an alternative solution for Muslims in an Australian landscape. With the number of Muslims in Australia growing by more than 6 per cent every year, we’re excited to be bringing this new type of banking to the Australian community,” the CEO added. Similarly, for personal finance – Islamic Bank Australia would purchase the item and then sell it to the customer.

This leaves Australian firms and workers in good shape to meet a recovery in demand. Our unemployment rate, already the second-lowest among the major advanced economies, is set to fall further, to 4¾ per cent by mid‑2012. Our exemplary performance throughout the economic crisis has meant Australia largely avoided the business failures and large-scale employment losses seen in many other countries.

"The question for them arose whether they could actually undertake the Islamic banking activities within the Australian framework. And the decision was made that that was quite a difficult prospect." Some time ago, Amanah Finance's Asad Ansari consulted for an offshore Islamic bank that was interested in setting up a branch in Australia. Imran says NAB isn't looking to play in the consumer Islamic finance space. He believes the big opportunity for Australia is setting up mechanisms that can allow offshore companies to invest here. "I'm a Halal butcher, with a Halal investment, and a Halal superannuation."

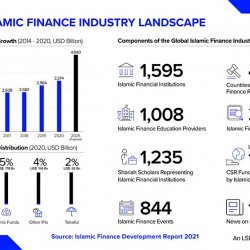

It is now over to the growing corpus of experts in Islamic finance in Australia – such as the many of you here today – to make thoughtful, forward-looking contributions to this comprehensive process. Over the past ten years, Islamic finance has experienced rapid growth, with the value of worldwide Islamic finance assets projected to reach US$1.6 trillion by 2012, almost double the amount of today's assets. We have already made progress on the recommendations in the report, in addition to introducing other initiatives to improve our international competitiveness. In September 2008, we commissioned a report into how we can work towards that goal. On 15 January this year, the Government released the report, Australia as a Financial Centre – Building on our Strengths, known as the Johnson Report. This global recovery is pushing up prices for Australia's key commodity exports and this is expected to cause a substantial rise in the terms of trade in 2010.

In the context of Islamic finance, the ‘Islamic Bank’ has become the third limb or intermediary between the users and providers of capital. Asad was an adviser to the Australian government's review of the taxation impact of Islamic finance in 2011. He's seen the sector grow but also battle to fit around Australia's banking framework. Australia's finance sector is tapping into the Islamic market, with one of the country's biggest lenders launching a Sharia-compliant loan and smaller institutions vying to become the first bank for the nation's Muslim population.

However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market. This means you’ll need to provide evidence of funds for your deposit, your savings history, employment history as well as information related to any other assets or liabilities you have. “Together with the products, we’re building an incredible digital experience for our customers.

"The existence of recognised and regulated super-funds that invest according to Islamic Finance principles is hence a welcome advancement, as it lessens such constraints," he says. Australia is among the nations in which Islamic Finance is growing most rapidly. This is according to the recently released Islamic Finance Development Report 2018, compiled by Thomson Reuters and the Islamic Corp for the Development of the Private Sector. The report shows a global annual growth of 11 per cent in 2017 to more than US $2.5 trillion in assets. Adhering to Islamic principles, Islamic Finance is growing in Australia and could contribute to the non-Muslim community and economy, not to mention boost the workforce and improve social inclusion.

What is Islamic Finance all about? Research University of South Australia

The consultation meetings were attended by representatives from taxation professional bodies, major law and accounting firms, various major corporations and business associations. Where an Islamic financial product is economically equivalent to a conventional product, the tax treatment of the two products should be the same. We assist thousands of Australians each month choose a banking, energy or insurance provider. Potentially, more information will be released closer to the bank’s opening date around profit sharing.

While there are several foreign banks in Australia, including the Arab Bank and HSBC, few of them offer Islamic home loans. However, Westpac and National Australia Bank have introduced Sharia-compliant products to the market. Mozo provides factual information in relation to financial products.

The more funds you repay, the more ownership you have in the property until it is paid off in full. Keep in mind that just because the institution doesn’t charge interest, doesn’t mean it doesn't charge a profit. The financial institution still makes a profit from leasing the property to you.

"One of the great things about Australia is we live in a nation where so many different people from different cultures or different religious backgrounds, or even no religion at all, can get on." "The question for them arose whether they could actually undertake the Islamic banking activities within the Australian framework. And the decision was made that that was quite a difficult prospect." Imran says NAB isn't looking to play in the consumer Islamic finance space.

Our experienced consultants can help your business reach new heights by offering Ijarah lease agreements to enable your business to acquire or lease assets such as motor vehicles, trucks, plant equipment, machinery & more. Ijarah Finance was established to help you purchase a property without entering into an interest-based mortgage. Our Home Ijarah products can be tailored to suit individual needs. If you're buying your first home, an investment property or if you want to change your current home loan to a Shariah compliant option we can help. MCCA’s finance products stand apart from other options open to Australian Muslims.

APRA grants restricted ADI licence to Australias first Islamic bank

Instead, they follow Mudarabah principles and earn you money through profit shares. There’ll be term deposits available from 1 to 12 months, and an automated rollover feature that puts your money back in a term deposit when it hits its maturity date. Traditional term deposits in Australia are a secure type of investment that earns you interest over a period of time.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product.

Some homebuyers mistakenly think Islamic home loans in Australia just make a superficial effort to comply with Islamic law, but that couldn’t be further from the truth. Often, that’s because they see Sharia-compliant products displayed with an interest rate. Sharia-compliant financiers are bound by Australian regulations to show products in this way. Australia is lucky enough to have a growing, vibrant Islamic community and Savvy partners with several lenders who offer fully Sharia-compliant home loans to meet increasing demand.

The providers of this style of finance all operate under the National Consumer Credit Protection Act and will make independent enquiries into your ability to meet the financial commitments without undue hardship. This often means Islamic finance comes in the form of a “ full doc” application process. In most cases, you are offered the same features as a typical home loan. Some of these help you in achieving property ownership sooner, while others can give you the option of lower payments if you make lease payments only.

At the start of the loan, that’s dictated by the size of the deposit that the homebuyer provides. You could say that the primary difference between a traditional Australian mortgage product and Islamic home loans is that with the former, the lender charges interest for providing a sum of money. However, with the latter, the financier charges for providing their share of sole occupancy of the property. “Just like any conventional facility in any other organisation, customers should be alert to the service aspect of the product. I believe Iskan Finance operates as an ethical business and we’re firm on NCCP compliance so people should take the comfort in the fact that we, and other providers, respect people’s rights under Australian law." While Islamic Bank Australia is not currently open for business, it plans to eventually offer a full suite of retail and business banking services in Australia.

“With the number of Muslims in Australia growing by more than 6 per cent every year, we’re excited to be bringing this new type of banking to the Australian community,” said Islamic Bank Australia CEO Dean Gillespie. Fixed cost development, licensing and hosting fees for the use of financial calculators, key fact sheets and research. Islamic law says that interest can’t be charged or paid on any financial transaction. Mr Gillespie also said that Islamic banks were inherently ethical, refusing to deal with certain industries. “With the number of Muslims in Australia growing by more than 6% every year, we’re excited to be bringing this new type of banking to the Australian community,” said Islamic Bank Australia CEO Dean Gillespie. Mr Gillespie was formerly Head of Home Loan Distribution at Commonwealth Bank, and Head of Mortgages at Bankwest.

Mr Zoabi said a block of 25 apartments in Huskisson on the south coast of NSW – all of which had been sold – had been waiting to be developed. The developer did not have all the equity but did not want an interest-accumulating loan due to their faith. Islamic superannuation must not be invested in interest, alcohol, weapons, tobacco, pornography or pork. More than 30 years later Australia – with a Muslim population of about 1.2 million – is beginning to open up to the untapped Islamic finance market, estimated by global researcher Salaam Gateway to be worth $248 billion. “Interest-free banking was non-existent in Australia, but it did exist in Canada where I had previously been studying,” he said.

This means you’ll need to provide evidence of funds for your deposit, your savings history, employment history as well as information related to any other assets or liabilities you have. The purchase of a property is typically financed through a mortgage agreement where the property is financed through borrowed funds from the lender. The borrower is required to repay this loan amount, plus interest, via a predetermined repayment schedule. After a successful pre-assessment a finance executive will prepare your application for submission.

We pay our respect to their Elders past and present and extend that respect to all Aboriginal and Torres Strait Islander peoples today. There is an explanation given to customers, and Aykan says the term is little more a formality. "What the MCCA has experienced, because the whole conventional system is based on the understanding of interest, is that our funders, our regulators, and whole heap of other bodies always use the word interest," says Aykan. Perhaps the largest issue, however, is the fact many Australian Muslims, while growing in number, see the traditional lending method with banks here to be both easier and cheaper. Dynamic asset allocation is ‘critical’ during times of economic uncertainty, according to a leading research and investment consultancy…. Mr Gillespie previously served as head of home loan distribution at the Commonwealth Bank and as head of mortgages at Bankwest.

The future of Islamic banking in the western countries, what we need to know

We pride ourselves in engaging with a range of local Islamic scholars and we are the only provider to be endorsed by the Board of Imams Victoria and President of the Imams Council of Queensland . The global coronavirus pandemic may be causing a lot of anxiety and stress for people across Australia. Secure the future of your children by setting aside a fund for them. You can earn returns on the amount as you continue to increase the fund towards a future they truly deserve.

For information on how we've selected these "Sponsored" and "Featured" products click here. You might want to pay fortnightly or even weekly, so make sure that your institution will let you do this. Islamic law says that interest can’t be charged or paid on any financial transaction.

“It’s the flexibility of the link between those two funds that should be attractive – a choice of income or capital, drawing on the benefits of both,” Dr Hewson said. The data, which is derived from a June survey of 1,002 broker customers and conducted by Honeycomb Strategy,… Hejaz Financial Services has been active in Australia for over a decade and assists Muslims in making various aspects of Australian finance, such as Supers and Investment, compliant with their religious beliefs. You’ll receive the latest industry news, tips and offers straight to your inbox. Many of our members are hard-working Muslims, who have been looking to earn a flexible income by becoming rideshare drivers.

With a 30+ year track record, we provide a compelling Islamic finance option for the Muslims of Australia.

However, if you’re a Muslim who wants to give ridesharing a go, it’s not always easy to find Islamic car finance among these options. "Of the four largest banks in Australia, the National Bank of Australia has so far started Islamic finance only in the business sector, not in the home loan sector," he said. The key to Islamic banking is interest-free financial transactions, and so it is different from conventional banking. Construction company Binah said the NAB’s sharia-compliant finance meant it could take on projects with development partners and fund them while maintaining core values of their faith. Practices like investing in alcohol companies are forbidden under sharia law.

For investment options that help grow your wealth while being Islamically sound, MCCA has the right options for you. To help you navigate the complex world of finance, insurance and utilities, we are committed to offering you a free service to help find you the right product to suit your needs. The prohibition on ambiguity often means that your provider will want to see very clear evidence that you can pay your mortgage and that you have a long history of sound financial management. Most Islamic mortgages have broadly the same features as regular products, including the option to overpay or even just to pay the lease amounts. How your loan to value ratio affects the amount you can borrow and how much your subsequent payments will be.

InfoChoice may receive a commission, referral, fee, payment or advertising fees from a provider when you click on a link to a product. We may sort or promote the order of these products based on our commercial arrangements. Sponsored products are products offered by a provider with which InfoChoice has a commercial marketing arrangement in place. If InfoChoice refers you to a provider, you will be dealing with that provider directly and not with us. InfoChoice accepts no liability in respect to any financial or credit product which you elect to acquire from any provider. Compare home loans from Australia’s major banks, credit unions and other lenders at InfoChoice.

The company, which was founded in 2011, provides end-to-end omnichannel digital services to both B2B and B2C brands. That's more difficult in Australia because stamp duty means such transactions are effectively double-taxed, said Andrew Johnston, the head of Islamic finance at law firm Sparke Helmore. Although the principle of ribā prevents Muslims from taking out conventional home loans, because it would be wrong to pay interest, a loan like this does not require you to do so. Michael Bleby covers commercial and residential property, with a focus on housing and finance, construction, design & architecture. Among both Muslim and non-Muslim Australians the proportion of people owning with a mortgage was about 37 per cent, indicating many Muslims are already accessing non-Muslim financing methods. Home ownership among Australian Muslims is half that of the national average, but they are just as likely to be chasing the Australian Dream of their own property.

It complies with Islamic law and serves a function similar to a bond. It refers to gambling, which is illegal for the same reasons as Gharar. No Muslim can have involvement in any contract where the ownership of property depends on uncertain events. Islamic law regards Gharar as unethical because it is inequitable. One person in the interaction has an advantage in knowledge or resources.

Australias leading Islamic finance and investments

Driven by our Islamic values and ethos, our Shariah advisors ensure all our products are Shariah compliant. From a market size of $150 billion in the mid-1990s, total global Islamic finance is likely to reach $6.5 trillion by 2020, according to a KFH research report. The worldwide Islamic finance industry is estimated to be worth $US3.5 trillion ($A5.2 trillion) by 2024, according to a report launched on Thursday in Australia on the state of the global Islamic economy. "We expect Australia to license online-based Islamic finance in 2021. Then we will really understand the demand for Islamic finance in Australia," he said. But Dr Choudhury personally believes adding informal banking, the value of Islamic banking would be about AUD 5 billion. "In a country with a small population like Australia, a 2.5 billion industry is a pretty big industry," said Dr Tonmoy Choudhury.

Dr Azad said Australia's historical reticence to move into the sukuk market may be due to an unfamiliarity or discomfort with Islamic finance, in part driven by Islamophobia. Islamic finance is almost a $3 trillion industry worldwide, largely fuelled by the expansion of sukuk markets. Sukuk issuance has grown exponentially in the last decade, since being introduced in the Middle East, Malaysia, Indonesia, Hong Kong and Japan, with the market also rapidly expanding into Europe and the US. Mr Gillespie also said that Islamic banks were inherently ethical, refusing to deal with certain industries.

"This variable outweighs religion in terms of importance for patronising types of banking. Therefore, unless people see actual benefits in terms of returns, the extent of patronisation will be nominal." "The difference between Islamic and Western banking is the notion of interest rates," says Nail Aykan, marketing manager with the Muslim Community Cooperative of Australia . "In the Islamic beliefs, the interest rate is forbidden, hence there must be an alternative." This poses a clear difficulty for Muslims in Australia who would want to take out a mortgage while still following Islamic law.

The information we request will vary depending on your personal circumstances and includes documents to support income, deposit or equity, assets, liabilities such as current mortgages, car loans, credit cards etc. When considering an Islamic home you will need to think carefully about what you can afford. Different lenders have different rules about the size of deposit they require from you in comparison to the value of the property they will buy. They also charge rent at different rates once you move in, so you should really speak to several lenders and compare the rates, as well as comparing any fees involved. At the end of this time, the lender will give you the property as a gift.

However, you must consider additional concepts such as risk-sharing and the absence of ambiguity which make Islamic home loans unique, compared to traditional loan products. On this subject, Murphy states, “In Australia, the Muslim community comprises Pakistanis, Fijians, Indians, Malaysians, Egyptians and so on. It would not be uncommon for some people to come to me and say ‘I want my Imam to sign off on your program’. But then we’d have to do the same for everyone and try to represent all the different religions, which would be impossible.

We hold a restricted ADI authorisation granted by the Australian Prudential Regulation Authority . This authorisation allows us to offer banking services, but is subject to certain restrictions such as a cap on the amount of deposits that we can hold in total. The purpose of the “restricted” status is that we can test our systems and processes before launching as a fully unrestricted bank. To be eligible Islamic home loans, apart from having the Muslim faith, you’ll also need to provide proof of funds for your deposit, savings and employment history as well as information related to any other assets or liabilities you have. Moreover, before you apply for a specific loan, please make sure that you’ve read the relevant T&Cs or PDS of the loan products. You can also check the eligibility requirements to determine whether the product is right for you or not.

MCCA Islamic Home Finance Australia Shariah Compliant Halal Finance Muslim mortgage

'Mozo sort order' refers to the initial sort order and is not intended in any way to imply that particular products are better than others. You can easily change the sort order of the products displayed on the page. The Australian Prudential Regulation Authority has officially authorised the first Australian Islamic bank to have a restricted deposit-taking license under the Banking Act. “Whenever I speak to potential investors offshore, people get the proposition,” Mr Gillespie said. S move to grow its network of 400 accredited brokers, including through its recent partnership with outsource Financial, as well as Finsure. Hejaz Financial Services upgrades its application technology to “streamline applications” for brokers, as it expands its broker channel.

One of the more prevalent models used in Australia is called Ijarah Muntahia Bittamleek. This is where the Islamic financier buys the house for the client and then rents it to them over a fixed term, generally decades. Asad was an adviser to the Australian government's review of the taxation impact of Islamic finance in 2011. He's seen the sector grow but also battle to fit around Australia's banking framework. The moral foundations of Islamic banking For many Muslims, “interest” is something that must be avoided because it is considered prohibited under Islamic ethical-legal norms.

That said, after several years of working with scholars, Australia lawyers, regulators and suitable funding sources, we opened our doors to the public with our Islamic finance solutions in 2015. Finder acknowledges Aboriginal and Torres Strait Islanders as the traditional custodians of country throughout Australia and their continuing connection to land, waters and community. We update our data regularly, but information can change between updates.

At the time of the final lease payment, ownership of the home will be transferred to you in the form of a promissory gift or hiba. Australia's finance sector is tapping into the Islamic market, with one of the country's biggest lenders launching a Sharia-compliant loan and smaller institutions vying to become the first bank for the nation's Muslim population. Hejaz wouldn’t exist Islamic Bank In Australia if it wasn’t for Halal so it is our duty to provide you with authentic Sharia-compliant financial products and services. Our loans for SMSF investors offer extremely competitive rates and full features for those looking to build wealth through investment. Terms, conditions, exclusions, limits and sub-limits may apply to any of the insurance products shown on the Mozo website. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website.

This has lead to a majority of Aussie Muslims preferring traditional lending banks as they can be cheaper and more convenient. Specifically, sharia law takes issue with riba, roughly translated as ‘interest’, and it is one of the foundations of Muslim trade, home loans included. By providing you with the ability to apply for an insurance quote or a credit facility we are not guaranteeing that your application will be approved. Your application is subject to the Provider’s terms, conditions and criteria. If InfoChoice refers you to a provider, you will be dealing with that provider directly and not with us.

Are there any Sharia home loans or Islamic banks in Australia?

The information and products contained on this website do not constitute recommendations or suggestions to purchase or apply for any particular product. Any advice provided on this website is of a general nature and does not take into account your objectives, financial situation or needs. Products included on this site may not suit your personal objectives, financial situation or needs.

Consider the Product Disclosure Statement , Target Market Determination and other applicable product documentation before making a decision to purchase, acquire, invest in or apply for a financial or credit product. Contact the product issuer directly for a copy of the PDS, TMD and other documentation. The requirements to apply for Islamic home finance are similar to those of a traditional mortgage application. Essentially, applicants will need to substantiate their income in order to demonstrate their borrowing capacity, and provide proof of their intended deposit.

These loans are structured to work as a lease, “where ‘rent’ and ‘service fee’ are paid instead of ‘interest’,” according to the bank. Terms, conditions, exclusions, limits and sub-limits may apply to any of the insurance products shown on the Mozo website. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website.

None of the Islamic financing companies currently offering consumer finance products in Australia are licensed as fully fledged banks. That means that while they can offer home loans or super, they can't take deposits from customers. You may approach any of the Islamic banking institutions listed above that offer Sharia-compliant products to know your options.

In some cases, for a licensing fee, our finalists and / or winners may choose to display our award logos in their marketing materials and on their website to promote the quality of the product to the public. Please take an opportunity to read InfoChoice’s Privacy Policy, Terms of Use Policy and Financial Service Guide and Credit Guide . For information on how we've selected these "Sponsored" and "Featured" products click here. You might want to pay fortnightly or even weekly, so make sure that your institution will let you do this. Islamic law says that interest can’t be charged or paid on any financial transaction. When you take an Islamic home loan, you’ll be using a product that’s devised with several principles in mind.

Islamic Bank Australia Islamic Bank In Australia Islamic Bank For Muslims

The granting of the licence means that Islamic Bank Australia has become the first Australian bank for Islamic borrowers. After you have settled you will have access to our on-line portal which is a convenient and secure way to pay bills, access your account balance and transaction history and make transfers and redraws. If you are refinancing, the valuation on the property is ordered immediately after you are granted a Conditional Approval. We will order a valuation of the property once you have provided us with a valid contract of sale.

The deposit they’re using might have been deposited by a pornography company the day before, so the money in that sense is not clean,” he said. More than 6000 interested customers have been “waitlisted” for its launch, Mr Gillespie said. The bank has attracted interest from both Muslim and non-Muslim customers. While the bank had to put its plans on hold after its last fundraising closed in January 2020 and APRA stopped processing new licences, Mr Gillespie said it was now full steam Sharia Home Loans Australia ahead recruiting and testing products. Invest your hard-earned money the halal way to own the house and call it home.

Mr Gillespie previously served as head of home loan distribution at the Commonwealth Bank and as head of mortgages at Bankwest. The authorisation will allow the bank to continue building Sharia Compliant Loans Australia its systems and processes before it begins testing with a small number of customers in 2023. Islamic Bank Australia has obtained a Restricted ADI authorisation from the Australian Prudential Regulation Authority , allowing it to build systems, implement processes and test with a small number of customers in 2023. Visiting Manama, Bahrain on a visit to the Gulf, the Assistant Treasurer met with the Central Bank of Bahrain and key government economic and banking officials. The Assistant Treasurer, Senator the Hon Nick Sherry, has today held a series of talks with the international leadership of the Islamic finance regulatory and banking sectors.

Islamic finance is based on a belief that money should not have any value itself, with transactions within an Islamic banking system needing to be compliant with shariah . Amanah Islamic Finance is an exquisite, trusted establishment, offering Islamic Finance is the most trusted and Shariah compliant establishment in Australia, with its products endorsed and approved by prominent Islamic Scholars. My personal experience with highly professional representatives who made the process fast, easy and efficient. Overall, Amanah Islamic Finance is highly recommended for anyone in the market looking for a trusted, Shariah compliant product. Home finance is based around co-ownership, with the bank charging rent to the customers when they are living as a tenant in the bank’s share of the property . The bank is raising $20 million to support its growth, but Mr Gillespie said the current market turmoil engulfing banks had not impeded its ability to raise funds.

Instead of charging interest on home loans, for example, the bank would charge rent based on how much deposit or principle was repaid. And at least two entities are seeking a licence to establish Islamic banks in Australia, alongside non-bank financial institutions that already offer sharia-compliant services. Islamic Bank Australia plans to offer a full suite of retail and business banking services.

The bank will first launch retail/personal banking with an everyday bank account, savings product (accounts that pay profit-share) and home finance (with co-ownership), before moving into business banking after a full licence is received. Islamic Bank Australia will initially launch into the retail/personal banking space with an everyday bank account, savings product and home finance before moving into business banking once it has received a full licence. Islamic Bank Australia will first launch retail/personal banking with an everyday bank account, savings product and home finance, before moving into business banking after a full licence is received. While the bank is not yet open for business , it has said it will offer a full suite of shariah-compliant retail and business banking services.

Loading 3rd party ad content

What you need to know as an MCCA customer, or more generally as a member of Australia’s Muslim community or the finance profession. Driven by our Islamic values and ethos, our Shariah advisors ensure all our products are Shariah compliant. “Even to the extent that they would rather hold savings in physical cash form at home despite the inherent security and safety risks and forgone earnings,” he said. To date, Victoria is the only state to recognise the potential for Islamic finance contracts to incur double stamp duty, introducing legislative exemptions in 2004. “One of the great challenges in starting Australia’s first Islamic bank is that you have all of these jurisdictional and legislative challenges that you don’t have when you’re running a conventional bank,” Mr Gillespie said.

“There are some really interesting structural elements that we negotiated to finalise this latest offering in order to ensure that we comply with Australian federal and state tax laws and at the same time remain true to Islamic principles. APRA has issued a restricted authorised deposit-taking institution licence to IBA Group, establishing the company’s brand Islamic Bank Australia as the country’s first Islamic bank. He leads a local team of industry specialists who together aim to create frictionless customer experiences through the application of digital touchpoints.

If you're buying your first home, an investment property or if you want to change your current home loan to a Shariah compliant option we can help. Contact Ijarah Finance for more information on Islamic bank mortgage and other services. Meanwhile Islamic Banking Australia – a group of Muslim Australians and industry veterans – have applied for a licence for a digital bank that is totally sharia-compliant. New banking entrants now need to launch both an income-generating asset product and a deposit product before they can secure a full licence, under APRA’s new standards.

The most powerful knowledgebase mapped from 20 years of research and insight into every WA leader and business. For more business news and analysis, visit NAB’s Business Research and Insights. NAB has cut fixed home loan interest rates for its four-year term to the lowest level in more than 20 years, giving borrowers value and certainty. National Australia Bank today announced that it has invoked its disaster relief package for customers impacted by bushfires in the Perth Hills area of Western Australia. The Assistant Treasurer also visited Deloitte's Islamic Finance Knowledge Centre in Bahrain and addressed a national roundtable of key figures from the Islamic finance industry in the Gulf region.

Yet, despite making an Australian gastronomic icon, over the years the small business owner has felt excluded from the country's financial system and investment opportunities. This attracts double stamp duty too, and was one area looked at by the taxation review that Asad participated in. But after the couple married in 2018, they started using an Islamic financing company to buy property.

A seminal book on Islamic finance by the world-renowned Mufti Taqi Usmani, this is a must-read for anyone interested in the key concepts, rules, and ideas behind modern Islamic finance. With a 30+ year track record, we provide a compelling Islamic finance option for the Muslims of Australia.

If you decide to apply for a product you will be dealing directly with that provider and not with Mozo. Mozo recommends that you read the relevant PDS or offer documentation before taking up any financial product offer. For more information please see Mozo's FSG, General advice disclaimer or Terms of use. With its current APRA restricted licence, Islamic Bank Australia can only have a limited number of customers in 2023. The bank hopes to obtain APRA approval to offer its products to the general public by 2024. On 3 May 2016, the Government announced the release of the Board’sfinal reporton the taxation treatment of Islamic finance, banking and insurance products.

Earlier this year, our digital engineering team at Mobiquity delivered an Islamic bank prototype with online car finance ("Murabaha") to support the growing global Muslim community. ESG — Environmental, Social, and Governance — has become the industry buzzword of 2022. However, while it all looks great on face value, customers are starting to question commitments from banks and financial institutions to not only environmental governance, but also its social counterparts.

Potentially, more information will be released closer to the bank’s opening date around profit sharing. That’s where Islamic Bank Australia comes in, to offer Sharia-compliant options to those who want it. In Australia’s banking system, interest is implemented everywhere, making it difficult for the 3.2% of Australians identifying as Muslims to follow their own laws. The Australian Prudential Regulation Authority has officially authorised the first Australian Islamic bank to have a restricted deposit-taking license under the Banking Act.

Sharia Compliant Home Loans How Do They Work?

New banking entrants now need to launch both an income-generating asset product and a deposit product before they can secure a full licence, under APRA’s new standards. It becomes the first Islamic bank in Australia, with all its banking products endorsed by “prominent Shariah scholars”. "Of the four largest banks in Australia, the National Bank of Australia has so far started Islamic finance only in the business sector, not in the home loan sector," he said. The Islamic Bank has an agreement with the traders for financing and one of the main functions of the bank is to monitor the profit and loss accounts of the traders concerned. While the bank had to put its plans on hold after its last fundraising closed in January 2020 and APRA stopped processing new licences, Mr Gillespie said it was now full steam ahead recruiting and testing products. “Our proposition is a segment-based proposition for Muslim Australians.

Our funds are strictly sourced only from Halal Car Finance our members and kept in an interest-free bank account. Find out the latest insights about Islamic finance and investments. Invest your hard-earned money the halal way to own the house and call it home. Switch your Self Managed Super to ICFAL and join a fund of $50 million+ that provides Shariah compliant returns on its investments.

“The other challenge with the conventional bank is it’s not clear where the funding is coming from. The deposit they’re using might have been deposited by a pornography company the day before, so the money in that sense is not clean,” he said. Sharia law also prohibits financing pornography, alcohol and gambling. Mr Gillespie said IBA had extended the remit for ethical banking to exclude live animal exports, big polluters and weapons. With the number of Muslims in Australia growing by more than 6 per cent every year, we’re excited to be bringing this new type of banking to the Australian community,” the CEO added.

"Some people are really conscious about what rate they are paying, whereas others don't mind paying the extra amount to do it in a compliant way." The MCCA has also taken on some of the risk in this transaction, as it essentially has made the purchase on behalf of Tabiaat. According to the MCCA, the mortgage can either be seized by the funder or left with the borrower given that it is registered for full mortgage securities entitlement to the funder.

She has a Masters in Advertising, Public Relations and Journalism from the University of New South Wales and a Bachelors in Business from the University of Technology Sydney. Look for a lender that offers weekly, fortnightly or monthly payments so you can arrange your payments to suit your income. The property he'd like to purchase is valued at $310,000 and with his $60,000 deposit, he needs help coming up with the $250,000 difference before the house can be transferred to him.

If you want more information or have questions, check out Islamic Bank Australia’s website and contact them directly. In the meantime, stay up to date with the latest banking news on our bank account news and advice page. Typically everyday bank accounts under Sharia Law do not accumulate any interest.

This particular account follows the Islamic principle of Wadiah–safe-keeping your funds with a financial institution–and is approved by several Islamic scholars. InfoChoice may receive a commission, referral, fee, payment or advertising fees from a provider when you click on a link to a product. We may sort or promote Sharia Loans the order of these products based on our commercial arrangements.

Join online and start your investment journey towards financial freedom. Take our quick Risk Profile Quiz to find the right investment product for you. Get a cash lump sum of $2,000+ for refinancing to a low-rate loan. This alternative method of obtaining a home is designed to better align with Sharia law to offer Muslims a means of pursuing home ownership without offending their religious values. Islamic finance is underpinned by Sharia values that are consistent with Islamic legislation.

Over time, the rent and profit on share purchases paid to ICFAL can change depending on market forces on the real estate market. These rates are reviewed every 3, 5 or 10 years depending on a member’s request. The rent and profits paid under our Musharaka financing model are calculated based on the actual rent and property prices using an independent valuer. It is not tied to the prevailing market interest rates in any way. This method of Islamic financing differs from a traditional loan in that monies are not simply extended by the financier to the customer for the purchase of an asset, as is the case with a traditional loan. Rather, an asset is purchased by the financier and then sold to the customer.

Even during these challenging times their team are willing to help. After you have settled you will have access to our on-line portal which is a convenient and secure way to pay bills, access your account balance and transaction history and make transfers and redraws. Remember, if you change your mind cancelling a sale may become an expensive exercise. We will send you a conditional approval which gives you an indication of how much finance we may provide you. The conditional approval is also subject to certain conditions which may include a satisfactory valuation that is conducted by an independent valuer. To get started we will conduct an initial pre-assessment to determine how much we can finance you and whether you will fit the requirements for eligibility.

Ingen kommentarer endnu