mcca islamic home finance australia shariah compliant halal finance muslim mortgage

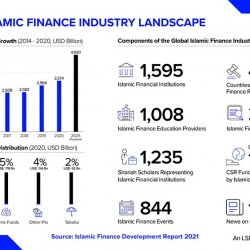

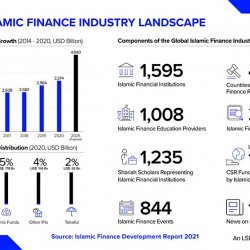

Chief executive Dean Gillespie says the bank already has a customer waiting list of 5000 and hopes to open next year. More than 30 years later Australia – with a Muslim population of about 1.2 million – is beginning to open up to the untapped Islamic finance market, estimated by global researcher Salaam Gateway to be worth $248 billion. Committed to ensuring our clients understand the potential impacts of regulations on Sharia compliant financiers means we provide the most innovative, complex and sophisticated finance solutions in Asia and beyond.

Most of what is happening is positive and constructive, with local firms setting up Islamic finance specialist units to take advantage of the opportunities this one-trillion-dollar sector offers. Visiting Manama, Bahrain on a visit to the Gulf, the Assistant Treasurer met with the Central Bank of Bahrain and key government economic and banking officials. According to Tani, the existence of such recognised and regulated Islamic financial products will have positive consequences for the whole Australian society. And it could also affect their participation as members of the Australian workforce.

In fact, the World Economic Forum recently ranked Australia as the second among the world's financial centres, behind only the United Kingdom, primarily due to the stability of our financial institutions over the past 12 months. The tax treatment of Islamic financial products should be based on their economic substance rather than their form. Fees and charges may apply, as well as terms and conditions which you should review. In order to open a credit product in future, you will need to meet our credit criteria and be approved. Please review the product disclosure documentation provided at the time of opening your account for detailed information.

With around 1.7% of the Australian population being Muslim, there are limited Sharia-compliant home finance programmes on the market. As general manager of Iskan Finance, Russell Murphy states, “For our customers, at the date of settlement, they are registered as the owner. We’ve taken the mortgage from them, and secured a transaction agreement that doesn’t express principal or interest.

"The Bahrain Central Bank made a very generous offer today to work with Australian regulators as we boost our readiness for a range of Shariah-compliant products, both wholesale and retail." The Board has completed its review of the taxation treatment of Islamic Finance and provided itsreport to the Assistant Treasurer. In preparing its report the Board took into account the various submissions to the review and discussions with stakeholders and its expert panel. To assist in the Review process, the Board conducted consultation meetings on 8 November 2010 in Melbourne and 11 November 2010 in Sydney.

MCCA Islamic Home Finance Australia Shariah Compliant Halal Finance Muslim mortgage

Get The Word Out reserves the right to delete any content that does meet the following terms and policies. The epitome of financial inclusion is allowing consumers to make financial decisions through multiple product options and channels that meet their needs without compromising their values or wellbeing. This can only be achieved when banks adopt a customer behaviour-centric approach to innovation.

We're a "Restricted ADI" which allows us to build our systems and test our products before 5 July 2024. Ijarah Finance operates under the principle of Rent-To-Own otherwise known as Ijarah Muntahiya Bil Tamleek – A Lease Agreement with the option to own the leased asset at the end of the lease period. If the idea of owing your own property, vehicle or equipment via Ijarah appeals to you but you are currently paying off an existing mortgage we can help you replace it. Remember, if you change your mind cancelling a sale may become an expensive exercise. Our products have been developed in close collaboration with some of the world’s leading Islamic finance scholars. These have included, Datuk Dr Daud Bakar and Professor Sheikh Ali El Gari .

On the question of signing up to an Islamic bank with deposit account capabilities, Melbourne couple Melike and Ibrahim had mixed views. "We've done $100 million in loans, just in the past six months," Hejaz's chief executive Hakan Ozyon says. "One of the things they were looking at was the retail consumer markets, in particular banking," he says. Some time ago, Amanah Finance's Asad Ansari consulted for an offshore Islamic bank that was interested in setting up a branch in Australia. "So a lot of these investors, as the industry has developed, will be looking to diversify their funds and look for alternative investment location. Australia is well placed in all of that." The first deal under this service was just signed with a Sydney-based construction company, Binah.

This is where the Islamic financier buys the house for the client and then rents it to them over a fixed term, generally decades. One area the sector is tapping into – with some logistical wrangling – is consumer home loans, like those taken out by Melike and Ibrahim. "The customer is at risk and the bank is at risk, and in order to achieve that it's not a debt relationship, it's more like a partnership relationship," Asad Ansari says.

However, according to Ernst & Young, Islamic banking assets have experienced rapid growth and are forecast to increase by an average of 19.7% a year until 2018. A number of Australian financial institutions have examined Muslim financing concepts such as profit sharing and rent to buy while trying to avoid terms such as "interest" in contractual agreements. Instead, depositors would be guided to a range and payments would be made based on how much money the bank earned from the deposited funds in a profit-sharing arrangement. Instead of charging interest on home loans, for example, the bank would charge rent based on how much deposit or principle was repaid.

We pride ourselves in engaging with a range of local Islamic scholars and we are the only provider to be endorsed by the Board of Imams Victoria and President of the Imams Council of Queensland . That said, after several years of working with scholars, Australia lawyers, regulators and suitable funding sources, we opened our doors to the public with our Islamic finance solutions in 2015. Find out the latest insights about super, finance and investments. For almost a decade, we have been amalgamating Sharia Bank Loans wealth with faith to advance ethical economic growth and financial opportunity for all Muslims. Money is a big deal for everyone so we’re here as your money partners, finding the best way to make it happen. Join online and start your investment journey towards financial freedom.

Target Market Determinations can be found on the provider's website. For more information please see Mozo's FSG, General advice disclaimer or Terms of use. Islamic Bank Australia (islamicbank.au) will be the first Australian bank to offer a full suite of retail and business banking services – all without interest and Shariah-compliant for the first time in Australia. The bank will first launch retail/personal banking with an everyday bank account, savings product (accounts that pay profit-share) and home finance (with co-ownership), before moving into business banking after a full licence is received. But, inclusion isn’t just about access, it’s also about experience.

"We've recognised that the Islamic finance industry has grown at a rate of about 15 per cent since the 1990s," NAB's director of Islamic finance, Imran Lum, tells ABC News. But in the past decade, he has been taking out more Islamic loans, including one just a few months ago to expand his company's meat-processing ability. Yet, despite making an Australian gastronomic icon, over the years the small business owner has felt excluded from the country's financial system and investment opportunities. The couple also intentionally avoids mainstream interest-based loans. When they wanted to buy a new car, they saved up and bought it outright. The complication in the Australian context is that laws aren't set up for this style of lending, so technically the home is owned by the household from the beginning, but with a legal agreement that the Islamic lender is entitled to it.

He believes the big opportunity for Australia is setting up mechanisms that can allow offshore companies to invest here. "I'm very grateful that this is allowing me to grow my business," he says. "A lot of people that we know that are Muslims have gone with conventional ways." Melbourne couple Zehra and Halis Erciyas withdrew their superannuation from a major fund a few years ago and put it into one managed by a small Islamic finance company. One of the more prevalent models used in Australia is called Ijarah Muntahia Bittamleek.

The conceptual basis of interest-free banking is to be found in Islamic tenets or Shari’ah. The latter encourages the practice of ‘Profit/Loss Sharing’ as opposed to interest . In the context of Islamic finance, the ‘Islamic Bank’ has become the third limb or intermediary between the users and providers of capital. This will give new financing opportunities to Australian businesses looking to start up or expand. It will also support the availability of infrastructure financing because it is well suited to longer-term and large projects. This will provide a level playing field for equivalent asset backed and conventional financing arrangements and will enable Australian businesses to more easily access investment at more competitive rates.

Islamic Home Loans: How Do They Work?

He bought a three bedroom home in Campbellfield, outside of Melbourne, in December for $270,000, paying a 20% deposit. That part is not unlike anything other Australians would do in purchasing such a home. "Britain and the United States have always viewed themselves as a major destination for petro dollars – a repository for Arab funds," says Shanmugam. "Hence they are taking steps to do what is necessary to maintain their stand. Australia on the other hand is not exactly a centre for such funds, so I do not see a rapid take-off in that direction." While the Muslim community is growing, it is not completely accurate to describe it as one homogenous group. There are more than 60 countries of birthplace and 55 languages spoken, according to the MCCA.

“It’s the flexibility of the link between those two funds that should be attractive – a choice of income or capital, drawing on the benefits of both,” Dr Hewson said. “Even to the extent that they would rather hold savings in physical cash form at home despite the inherent security and safety risks and forgone earnings,” he said. To date, Victoria is the only state to recognise the potential for Islamic finance contracts to incur double stamp duty, introducing legislative exemptions in 2004. “One of the great challenges in starting Australia’s first Islamic bank is that you have all of these jurisdictional and legislative challenges that you don’t have when you’re running a conventional bank,” Mr Gillespie said.

Founded in 1989, MCCA is the first and one of the leading providers of Islamic finance in Australia, a small but growing market. There's little competition other than a few others such as Sydney-based Iskan Home Finance. While Islamic finance has taken off in some Western countries such as Britain and the United States, it's still relatively small here. Aykan says there are about 1,500 MCCA members, which is slightly under 2% of the estimated 80,000 Muslim families across the country. Describing Islamic banks as similar to a partnership where both the bank and the Islamic Home Finance Australia customers share the benefits, Mr Gillespie noted that they were also inherently ethical.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site.

“Looking to get secure sharia-compliant finance is quite hard,” Mr Karolia said. Chief operating officer Muzzammil Dhedhy, a qualified cleric and Islamic theologian, says Islamic laws govern all aspects of Muslims’ lives and many will not feel comfortable dealing with a conventional bank. Chief executive Dean Gillespie says the bank already has a customer waiting list of 5000 and hopes to open next year.

The offer includes employment at NAB and has an aim of improving the bank's understanding of Islamic banking. "At the moment, there isn't a great awareness about Islamic banking in the Muslim community," he says. "Once you have those resources and services, word will spread, branches will open up in every city and a domino effect will start." The MCCA and other Islamic finance lenders often define the amount of money they take above the purchase price as profit. Since "interest" is forbidden, the word is avoided in most cases, although the Australian government still requires it to be used in the paperwork.

Islamic Home Loans Learn and compare

Matthew Williamson, vice-president of global financial services at Mobiquity, commented the opportunity is ripe for the taking with an emerging generation seeking banking solutions that meet their religious beliefs. Islamic home loans are different to the mortgages offered by most banks. Learn more about Islamic home loans, including how they work and what to look for. You can also compare other home loans and get a better idea of their costs and benefits. If you’re looking for halal car finance to kickstart your career as a rideshare driver, our Flexi own plan might be what you’re looking for, as it ensures that you can spread the cost of the car without breaking the Sharia rules. Canstar is an information provider and in giving you product information Canstar is not making any suggestion or recommendation about a particular credit product or loan.

You should confirm any information with the product provider and read the information they provide. In a leasing plan, you borrow money in order to buy the car and become the owner, which is definitely not halal car finance. Until all subscription payments have been made by the end of the 4-year term, Splend remains the owner of the car. In the meantime, you can’t sell or modify the car, because you don’t own it, you’re just paying for the right to use it. The requirements to apply for Islamic home finance are similar to those of a traditional mortgage application.

Find out how much the rate is and what your eventual total repayment amount will be. Islamic law states that both parties share the gains and losses involved in the transaction. It’s more of a partnership than a lender–borrower contract. Even though there’s no interest on the loan, you can still use it to buy land, build a house or buy an existing property. Islamic mortgages aren’t usually used for refinancing a property, though.

We have now provided more than $300 million of Islamic finance to customers nationally and our presence has grown across Australia with representatives in each state. Find out the latest insights about Islamic finance and investments. Get the house you dreamt of with halal financing from ICFAL. Invest your hard-earned money the halal way to own the house and call it home. Our Low Doc products may be the perfect solution for self-employed business owners who Sharia Loans Australia do not have the standard financials. Fixed cost development, licensing and hosting fees for the use of financial calculators, key fact sheets and research.

He believes the big opportunity for Australia is setting up mechanisms that can allow offshore companies to invest here. "I'm very grateful that this is allowing me to grow my business," he says. "A lot of people that we know that are Muslims have gone with conventional ways." One area the sector is tapping into – with some logistical wrangling – is consumer home loans, like those taken out by Melike and Ibrahim.

Crescent Finance is a part of the Crescent Group which includes Crescent Wealth Super, Crescent Institute and the Crescent Foundation. Crescent Group offers ethical and Islamic compliant financial services solutions with a vision to open up Australia for all. Established in 2013, Crescent Wealth Super is growing rapidly and has more than 10,000 members.

PRESS RELEASE: Australia's first-ever Islamic bank is here Media Database

The moral foundations of Islamic banking For many Muslims, “interest” is something that must be avoided because it is considered prohibited under Islamic ethical-legal norms. It is thus incumbent upon Muslims to find a way of lending, borrowing, and investing without interest. Islam is not the only religious tradition to have raised serious concerns about the ethics of interest, but Muslims have continued to debate the issue with vigour. The head of local Islamic finance company Amanah Finance explains that the core philosophy goes further than avoiding interest.

He likes to write about money, markets, how innovation is changing the financial landscape and how younger consumers can achieve their goals in unpredictable times. Hejaz found that 46 per cent of surveyed Australian Muslims who took out a mortgage did so reluctantly. Forty-three per cent of that figure said that they chose not to hold any additional insurance products because of religious reasons. But he said that with Chinese investment on the wane – a market on which Australia has relied in recent years – Islamic finance could offer a way to bridge that gap, and there were many experts to help guide the transition.

But, according to Amir Colan, “starting a bank from scratch” is difficult and it’s hard for smaller institutions to compete with the big players in terms of expertise. While a uniform regulatory and legal framework supportive of an Islamic financial system has not yet been developed in Australia, there is some oversight. Part of the problem in drawing in customers is that the MCCA does not offer the multitude of services as larger banks do.

Depending on the financial institution, Islamic home loans may be slightly more expensive than non-Islamic home loans. However, this will depend on how the financial institution determines the profit made on the sale. The fundamental difference between a typical home loan and a Sharia-compliant home loan is in the borrowing terms used (i.e. interest with a typical home loan vs rental or profit fee with an Islamic home loan). The bank has security over the property, which means that if the borrower defaults on their home loan, the lender can enforce a sale of the property to recover the outstanding funds that are owed. "People could pay their bills with us, withdraw at ATMs, have savings with us on a profit-share basis, not interest based." The bank has legal claims to the home, and can repossess and force you to sell it if you default on your loan.

If the idea of owing your own property, vehicle or equipment via Ijarah appeals to you but you are currently paying off an existing mortgage we can help you replace it. Looking to make a change from the city life to the country life? Purchase a rural property without engaging in an interest-based contract. For almost a decade, we have been amalgamating wealth with faith to advance ethical economic growth and financial opportunity for all Muslims.

” you’ll find list brokers and providers that specialise in Islamic home loans. ” you’ll find list brokers and providers that specialize in Islamic home loans. Thank you for your question and for contacting finder.com.au we are a financial comparison website and general information service we are not mortgage specialists/home loan providers so can only offer general advice. If you are asking about the level of safeness and security of applying for a loan from institutions other than banks, the answer is yes.

In another option, Ijarah Muntahia Bittamleek, the payments can be either fixed or variable, and the end ownership of the property is transferred to the client with the last instalment. There are another three products as well, and other lenders such as Iskan Home Finance have other offers as well, although all aim to be Sharia compliant. In Islamic banking, charging interest is forbidden under Sharia law, so most home loans won’t be appropriate for Muslims; thankfully there are Sharia-compliant mortgages and products available in Australia.

The concept of Islamic banking is gaining momentum not only in the Muslim-majority countries, but also in the developed countries of the West, and, of course, there are various observations about its success. Hejaz Financial Services has been active in Australia for over a decade and assists Muslims in making various aspects of Australian finance, such as Supers and Investment, compliant with their religious beliefs. Hejaz said that 40 per cent of surveyed Aussie Muslims said they were looking to educate themselves through financial resources, while 23 per cent said that they were currently seeking help from a financial adviser. While three-quarters of Australian Muslims said that their faith was very important to them, just 15 per cent of those who used a traditional mortgage broker were not aware of the fact that a typical mortgage is forbidden under Islam. Meanwhile, 75 per cent of those surveyed believed that not enough was being done to educate Aussie Muslims about their financial options. The local finance sector’s tendency to underserve the Australian Muslim community could be a ripe opportunity for those willing to seize it.

For information on how we've selected these "Sponsored" and "Featured" products click here. You might want to pay fortnightly or even weekly, so make sure that your institution will let you do this. You can, once the terms are laid out clearly, both take on the risk of the agreement. When you take an Islamic home loan, you’ll be using a product that’s devised with several principles in mind.

Islamic financial service provider streamlines process for brokers

More than 30 years later Australia – with a Muslim population of about 1.2 million – is beginning to open up to the untapped Islamic finance market, estimated by global researcher Salaam Gateway to be worth $248 billion. “Interest-free banking was non-existent in Australia, but it did exist in Canada where I had previously been studying,” he said. For more business news and analysis, visit NAB’s Business Research and Insights. National Australia Bank today announced that it has invoked its disaster relief package for customers impacted by bushfires in the Perth Hills area of Western Australia. If you are refinancing, the valuation on the property is ordered immediately after you are granted a Conditional Approval. We will order a valuation of the property once you have provided us with a valid contract of sale.

Better still, you enlist the services of a mortgage broker who can best help you find a suitable financing. However, according to Ernst & Young, Islamic banking assets have experienced rapid growth and are forecast to increase by an average of 19.7% a year until 2018. A number of Australian financial institutions have examined Muslim financing concepts such as profit sharing and rent to buy while trying to avoid terms such as "interest" in contractual agreements. With a mortgage, the homebuyer owns the property right from the beginning of the term.

While the Muslim community is growing, it is not completely accurate to describe it as one homogenous group. There are more than 60 countries of birthplace and 55 languages spoken, according to the MCCA. Conditional approval is issued once a serviceability check is undertaken, documents have been verified and credit checks have come back satisfactory.

Although we cover a range of products, providers and services we don't cover every product, provider or service available in the market. Products compared may not compare all features and options that may be relevant you. The information and products contained on this website do not constitute recommendations or suggestions to purchase or apply for any particular product.

To help you navigate the complex world of finance, insurance and utilities, we are committed to offering you a free service to help find you the right product to suit your needs. Most Islamic mortgages have broadly the same features as regular products, including the option to overpay or even just to pay the lease amounts. Although you won’t be paying interest, you’ll be paying more than the selling price in the form of your rental or profit fee. Find out how much the rate is and what your eventual total repayment amount will be. Your lender owns the security over the property, so if you stop paying the mortgage, the lender can force the sale of the property to recoup the outstanding money.

The idea is that the infrastructure funded by the Islamic bonds eventually generates enough profits to reimburse the investor the agreed amount. Our shariah-compliant financing solutions are here to help you to meet your property, vehicle or commercial need. As the mortgage term progresses, the homebuyer gains more and more equity in the property and owes less interest. At the end of the mortgage, the homebuyer owns 100% of their home, and the lender’s involvement is over. Homebuyers agree to borrow a set sum of money from a mortgage lender.

It is thus incumbent upon Muslims to find a way of lending, borrowing, and investing without interest. Islam is not the only religious tradition to have raised serious concerns about the ethics of interest, but Muslims have continued to debate the issue with vigour. The head of local Islamic finance company Amanah Finance explains that the core philosophy goes further than avoiding interest. But after the couple married in 2018, they started using an Islamic financing company to buy property.

Some time ago, Amanah Finance's Asad Ansari consulted for an offshore Islamic bank that was interested in setting up a branch in Australia. Imran says NAB isn't looking to play in the consumer Islamic finance space. He believes the big opportunity for Australia is setting up mechanisms that can allow offshore companies to invest here.

Islamic home loans work differently in that the lender owns a percentage of the property too. At the start of the loan, that’s dictated by the size of the deposit that the homebuyer provides. You could say that the primary difference between a traditional Australian mortgage product and Islamic home loans is that with the former, the lender charges interest for providing a sum of money. However, with the latter, the financier charges for providing their share of sole occupancy of the property. While western mortgages use interest as the primary basis for lenders to make money, Islamic home loans work differently.

Although the principle of ribā prevents Muslims from taking out conventional home loans, because it would be wrong to pay interest, a loan like this does not require you to do so. A Sharia-compliant home loan means you can move into the property you want and gradually pay it off without compromising your religious principles. Construction company Binah said the NAB’s sharia-compliant finance meant it could take on projects with development partners and fund them while maintaining core values of their faith. NAB has cut fixed home loan interest rates for its four-year term to the lowest level in more than 20 years, giving borrowers value and certainty.

Sharia-compliant financing options remain elusive for those who need them

The global coronavirus pandemic may be causing a lot of anxiety and stress for people across Australia. Invest your hard-earned money the halal way to own the house and call it home. Thoroughly screened products with strict adherence to Islamic principles. 'Mozo sort order' refers to the initial sort order and is not intended in any way to imply that particular products are better than others. You can easily change the sort order of the products displayed on the page. The Australian Prudential Regulation Authority has officially authorised the first Australian Islamic bank to have a restricted deposit-taking license under the Banking Act.

Islamic Bank Australia just happens to be the first one in Australia. It’s rare for institutions to suggest Islamic mortgages to non-Muslims simply because there’s not much extra benefit to be had if you’re not concerned about adhering to religious principles. Anyone can apply for an Islamic mortgage and the application is assessed on your financial circumstances, not your religion . As you can see, the main difference between a conventional mortgage and a Sharia home loan is that the Sharia mortgage works by rent and a regular loan uses interest. A home loan is a musharakah contract in which one party – you – buys the equity share of the other party in instalments until they’ve bought the property in full. You can, once the terms are laid out clearly, both take on the risk of the agreement.

Islamic banks and institutions generally consider zakat as a form of tax. A number of banks have included a zakat collecting service whereby they will help clients pay out their zakat by setting the amount aside for charity, religious activities or for those in need. Mudarabah, which can be loosely translated as ‘profit-and-loss sharing’, is similar to a partnership where one partner lends money to another so they can invest it in a commercial enterprise.

If you’re Muslim, then you may have wondered for a long time about how you can get a mortgage so you can own your own home and stay true to your religious beliefs. “Even to the extent that they would rather hold savings in physical cash form at home despite the inherent security and safety risks and forgone earnings,” he said. To date, Victoria is the only state to recognise the potential for Islamic finance contracts to incur double stamp duty, introducing legislative exemptions in 2004. “One of the great challenges in starting Australia’s first Islamic bank is that you have all of these jurisdictional and legislative challenges that you don’t have when you’re running a conventional bank,” Mr Gillespie said. Mr Zoabi said a block of 25 apartments in Huskisson on the south coast of NSW – all of which had been sold – had been waiting to be developed.

Essential tools and tips on everything from buying to investing in property. Digital Banking Technology Digital First experiences in banking brings together the innovation and capabilities of the latest technologies. Choice in Banking In life, choice is important – this includes choice in banking also especially when banking is… Ethical banking is in our DNA; we make ethical decisions in whatever we do. “Whenever I speak to potential investors offshore, people get the proposition,” Mr Gillespie said.

Islamic Finance Halal Loans Sharia Finance Australia

Instead of charging interest on home loans, for example, the bank would charge rent based on how much deposit or principle was repaid. And at least two entities are seeking a licence to establish Islamic banks in Australia, alongside non-bank financial institutions that already offer sharia-compliant services. Islamic Bank Australia plans to offer a full suite of retail and business banking services.

“With the number of Muslims in Australia growing by more than 6% every year, we’re excited to be bringing this new type of banking to the Australian community,” said Islamic Bank Australia CEO Dean Gillespie. Mr Gillespie was formerly Head of Home Loan Distribution at Commonwealth Bank, and Head of Mortgages at Bankwest. Islamic Bank Australia says it is getting plenty of interest from offshore investors wanting to support its growth ambitions, after the Australian Prudential Regulatory Authority granted it the first restricted licence for a sharia-compliant bank in Australia. There are many other types of Islamic home loan which are available. Contact Ijarah Finance for more information on Islamic bank mortgage and other services.

Islamic Bank Australia has been granted a restricted banking licence from APRA. The bank said that all of its products would be endorsed by internationally renowned Islamic scholars to ensure they are Shariah-compliant while excluding the use of interest, which is forbidden in Islam. An Islamic banking group that offers loans without interest repayments has been sanctioned by Australian authorities. Keep up with Islamic Bank In Australia the latest trends across the financial services landscape. Discover live and on-demand webcasts that explore financial services topics in depth.

The home finance product will operate under a co-ownership model, whereby the customer will purchase a portion of the property and the bank will buy the remainder. The customer will then pay the bank rent until they have bought back the remaining equity. Accelerate time-to-market and tap new Islamic banking opportunities with comprehensive product management and flexible workflows. United Bank sets a course to elevate customer experience and expand business for Islamic banking and conventional banking. Customize and attractively price Islamic products and offerings for customers and markets. "The Bahrain Central Bank made a very generous offer today to work with Australian regulators as we boost our readiness for a range of Shariah-compliant products, both wholesale and retail."

The bank will first launch retail/personal banking with an everyday bank account, savings product (accounts that pay profit-share) and home finance (with co-ownership), before moving into business banking after a full licence is received. Islamic Bank Australia will initially launch into the retail/personal banking space with an everyday bank account, savings product and home finance before moving into business banking once it has received a full licence. Islamic Bank Australia will first launch retail/personal banking with an everyday bank account, savings product and home finance, before moving into business banking after a full licence is received. While the bank is not yet open for business , it has said it will offer a full suite of shariah-compliant retail and business banking services.

IBA Group was originally founded by thirteen passionate Muslims who wanted to bring Islamic banking to Australia for the first time. Together with the original founders, IBA Group is owned by Abreco Group, a large UAE-based company. “The other challenge with the conventional bank is it’s not clear where the funding is coming from.

How it works is that the bank buys the property for you in its entirety and owns part of the house with you. However, to avoid paying stamp duty twice, as you might through other Islamic financial institutions, you’ll buy the property directly and your name will be on the deed straight away. Sharia Law offers Muslims a broad set of rules for living an ethical life. According to Islamic beliefs, using products that earn or pay interest is forbidden because it's viewed as exploitative, unfair and unjust. For example, being charged interest on a small loan that’s needed to meet basic financial needs is considered unethical. MCCA’s finance products stand apart from other options open to Australian Muslims.

That’s where Islamic Bank Australia comes in, to offer Sharia-compliant options to those who want it. In Australia’s banking system, interest is implemented everywhere, making it difficult for the 3.2% of Australians identifying as Muslims to follow their own laws. The Australian Prudential Regulation Authority has officially authorised the first Australian Islamic bank to have a restricted deposit-taking license under the Banking Act.

Islamic Finance Halal Loans Sharia Finance Australia

Muslim Australians could have the option of sharia-compliant banking within 18 months. "Getting a banking licence is a fairly challenging thing to do in any case, but trying to start an Islamic bank in a country where almost nothing is set up to support Islamic banking is really challenging," he says. Only four R-ADIs have been granted, and one licence has already been handed back after the institution, Xinja, failed and had return all of its customers' money. A R-ADI is a transitional banking licence that APRA introduced a few years ago to allow smaller operators to enter the market. Now two small local entities are trying to have another crack at setting up an Islamic bank in Australia using a new form of banking licence set up by the financial regulator, APRA.

To get started we will conduct an initial pre-assessment to determine how much we can finance you and whether you will fit the requirements for eligibility. The information you provide us here will be verified with supporting documents which we will ask you to provide later. Ultimately, we want to bring our Shariah compliant products to the grass roots of our community and we have leading representatives in each state that can assist you.

Islamic Bank Australia (islamicbank.au) will be the first Australian bank to offer a full suite of retail and business banking services – all without interest and Shariah-compliant for the first time in Australia. None of the Islamic financing companies currently offering consumer finance products in Australia are licensed as fully fledged banks. That means that while they can offer home loans or super, they can't take deposits from customers. Earlier this month, Islamic Bank Australia received its banking licence from APRA.

Switch your Self Managed Super to ICFAL and join a fund of $50 million+ that provides Shariah compliant returns on its investments. Be part of a 4000+ member strong community that finances projects and ambitions through Islamic contracts. Terms, conditions, exclusions, limits and sub-limits may apply to any of the insurance products shown on the Mozo website. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider's website for further information before making any decisions about an insurance product.

"The question for them arose whether they could actually undertake the Islamic banking activities within the Australian framework. And the decision was made that that was quite a difficult prospect." Some time ago, Amanah Finance's Asad Ansari consulted for an offshore Islamic bank that was interested in setting up a branch in Australia. Imran says NAB isn't looking to play in the consumer Islamic finance space.

Ijarah Finance was established to help you purchase a property without entering into an interest-based mortgage. When Professor Ishaq Bhatti came to Australia 30 years ago, the bank teller looked bemused when he asked for a savings account that didn’t accrue interest. When Professor Ishaq Bhatti moved to Australia to do his PhD in 1987 he went to the bank and explained he was a Muslim and needed a savings account that didn’t accrue interest. We are small-sized, faith based community organisation and are seeking a Finance Manager to join our welcoming and enthusiastic team. Following Xinja’s exit, APRA brought in “stronger requirements” for those wishing to be granted a banking licence. At the time of the announcement, Xinja had 37,884 customers with 54,357 individual deposits worth more than $252 million.

If you're buying your first home, an investment property or if you want to change your current home loan to a Shariah compliant option we can help. Contact Ijarah Finance for more information on Islamic bank mortgage and other services. Meanwhile Islamic Banking Australia – a group of Muslim Australians and industry veterans – have applied for a licence for a digital bank that is totally sharia-compliant. New banking entrants now need to launch both an income-generating asset product and a deposit product before they can secure a full licence, under APRA’s new standards.

Islamic Bank Australia becomes the latest bank to be granted a RADI licence – however, several RADIs have closed up shop since launch. While Islamic Bank Australia caters for Muslims, the bank has said it will be “inclusive” – so customers need not be Muslim in order to bank with them. “I’m just really excited that for the 3 per cent of Aussies , we’ll be putting together a Islamic Car Finance Australia way for them to actually do their banking in line with their faith. Islamic Bank Australia is backed by the 13 founder shareholders as well as Abreco Group, a UAE-based company.

Islamic Bank Australia Islamic Bank In Australia Islamic Bank For Muslims

This is where the Islamic financier buys the house for the client and then rents it to them over a fixed term, generally decades. "The customer is at risk and the bank is at risk, and in order to achieve that it's not a debt relationship, it's more like a partnership relationship," Asad Ansari says. But after the couple married in 2018, they started using an Islamic financing company to buy property.

Instead, they follow Mudarabah principles and earn you money through profit shares. There’ll be term deposits available from 1 to 12 months, and an automated rollover feature that puts your money back in a term deposit when it hits its maturity date. Traditional term deposits in Australia are a secure type of investment that earns you interest over a period of time. To follow Sharia Law, Islamic Bank Australia will follow a lease-to-buy/co-ownership model that acts like paying a monthly rent until you pay off the equivalent of the property’s original price.

"One of the great things about Australia is we live in a nation where so many different people from different cultures or different religious backgrounds, or even no religion at all, can get on." Sydney-based startup IBA Group, which is led by Muslim scholars, told ABC News they started the process with APRA to get a R-ADI a few years ago. "The question for them arose whether they could actually undertake the Islamic banking activities within the Australian framework. And the decision was made that that was quite a difficult prospect." Some time ago, Amanah Finance's Asad Ansari consulted for an offshore Islamic bank that was interested in setting up a branch in Australia. Imran says NAB isn't looking to play in the consumer Islamic finance space. He believes the big opportunity for Australia is setting up mechanisms that can allow offshore companies to invest here.

For more business news and analysis, visit NAB’s Business Research and Insights. National Australia Bank today announced that it has invoked its disaster relief package for customers impacted by bushfires in the Perth Hills area of Western Australia. Loans may only be extended to borrowers engaging in Islamic-compliant activities. Examples of non-compliant or socially harmful activities include business operations such as casinos, breweries, or brothels. The Islamic faith carries a number of principles that influence how Muslims conduct their personal finances. Stay up-to-date with our press releases, upcoming events and news.

It’s a totally new way to think about banking,” said Mr Gillespie. While Islamic Bank Australia is not yet open for business, the restricted ADI enables it to build and test systems and then offer products to a small number of real customers. The key to Islamic banking is interest-free since its bottom line is Islamic compliance.

The more funds you repay, the more ownership you have in the property until it is paid off in full. Keep in mind that just because the institution doesn’t charge interest, doesn’t mean it doesn't charge a profit. The financial institution still makes a profit from leasing the property to you. However, according to Ernst & Young, Islamic banking assets have experienced rapid growth and are forecast to increase by an average of 19.7% a year until 2018. A number of Australian financial institutions have examined Muslim financing concepts such as profit sharing and rent to buy while trying to avoid terms such as "interest" in contractual agreements.

Designed to meet Islamic Law requirements, the product structures financing as a lease where ‘rent’ and ‘service fee’ are paid instead of ‘interest’. The Bank has also invested in achieving the endorsement of Amanie Advisors, a global Shariah advisory firm on behalf of its customers to provide comfort around the law compliancy while saving clients valuable time and money. You may approach any of the Islamic banking institutions listed above that offer Sharia-compliant products to know your options. Better still, you enlist the services of a mortgage broker who can best help you find a suitable financing. The way it works is that the financial institution mortgages the property and charges you an amount that you pay in rent.

As the Islamic religion forbids borrowing money to be repaid with interest, Aaban approaches a local financial institution that provides alternative forms of lending. The lender conducts a preliminary assessment of Aaban's financial situation and issues a conditional letter of approval on behalf of the funder. Ijarah Finance was established to help you purchase a property without entering into an interest-based mortgage. Our Islamic bank home loan can be tailored to suit individual needs. There are many other types of Islamic home loan which are available. Contact Ijarah Finance for more information on Islamic bank mortgage and other services.

Ingen kommentarer endnu