islamic home loans how do they work and how do you get one

The term ‘Islamic Banking’ is a constituent of ‘Islamic Finance’ and refers to the set of banking and financial rules and practices organized on a basis that excludes interest as a determinant in financial lending and borrowing transactions. The conceptual basis of interest-free banking is to be found in Islamic tenets or Shari’ah. The latter encourages the practice of ‘Profit/Loss Sharing’ as opposed to interest .

Of course, you should do independent research to confirm that the lender you are working with is registered and legitimate. The nature of the lease payments depends on the lease structure that is set out by the lessor. The agreement will also set out what happens to your rental payments when market interest rates fluctuate. Generally, it’s not possible in Australia to provide a fixed rental for the entire term of a mortgage.

After considering the views of all stakeholders the Board was requested to provide a final report to the Assistant Treasurer by June 2011. Information on this website does not take your personal circumstances, needs or objectives into account. We do not currently meet the full prudential framework and/or requirements, and you should consider this before depositing funds with us.

Even during these challenging times their team are willing to help. We have now provided more than $300 million of Islamic finance to customers nationally and our presence has grown across Australia with representatives in each state. Our Low Doc products may be the perfect solution for self-employed business owners who do not have the standard financials.

“There are developers that we work with that in the past just haven’t used any bank finance so we deliver projects with 100 per cent of their own equity,” said managing director Amen Zoabi. “Interest-free banking was non-existent in Australia, but it did exist in Canada where I had previously been studying,” he said. When Professor Ishaq Bhatti came to Australia 30 years ago, the bank teller looked bemused when he asked for a savings account that didn’t accrue interest. Under Islamic law, or Sharia, there is a prohibition on charging or paying interest, which is called riba and considered exploitative because the lender does not assume a share of the risk.

However, Australia’s credit laws still apply and the lender will still charge you for borrowing money. And the implications are vast, not only does this tick the box for inclusion, but so too does it begin to grow brand gravity. We also recognise there are Muslims in Australia who would use Islamic financial services if they were more accessible.

Confirm details with the provider you're interested in before making a decision. This alternative method of obtaining a home is designed to better align with Sharia law to offer Muslims a means of pursuing home ownership without offending their religious values. Look for a lender that offers weekly, fortnightly or monthly payments so you can arrange your payments to suit your income.

And of course, this opportunity is not limited to domestic Australian markets. Leading Australian firms will seek out opportunities to become involved in offering Islamic finance products in the global market so they can tap alternative funding sources and invest in new areas. On 13 October 2010, the Board of Taxation released itsdiscussion paper on the reviewof the taxation treatment of Islamic finance, banking and insurance products. The Chairman of the Board of Taxation announced the release of the discussion paper viaa press release. The Board has developed this discussion paper to facilitate stakeholder consultation. On 3 May 2016, the Government announced the release of the Board’sfinal reporton the taxation treatment of Islamic finance, banking and insurance products.

We offer an alternative solution for Muslims in an Australian landscape. With the number of Muslims in Australia growing by more than 6 per cent every year, we’re excited to be bringing this new type of banking to the Australian community,” the CEO added. Similarly, for personal finance – Islamic Bank Australia would purchase the item and then sell it to the customer.

Islamic banking is just the tip of an ethical industry movement

Home loan applications continue to decline, according to the latest Equifax data. Without this approach, the gap on financial inclusion will only widen or contribute to diminishing financial health. IBA's licence is timely too, with the 2021 Australian Census highlighting a 34.6 per cent increase in Australia’s Islamic population — now the second largest religion in our country. We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

We provide tools so you can sort and filter these lists to highlight features that matter to you. Get a cash lump sum of $2,000+ for refinancing to a low-rate loan. Your lending institution may approve your circumstance beforehand, allowing you to immediately choose a home that is within the price range they agreed upon, thereby facilitating your application process. This alternative method of obtaining a home is designed to better align with Sharia law to offer Muslims a means of pursuing home ownership without offending their religious values. Look for a lender that offers weekly, fortnightly or monthly payments so you can arrange your payments to suit your income. The property he'd like to purchase is valued at $310,000 and with his $60,000 deposit, he needs help coming up with the $250,000 difference before the house can be transferred to him.

He believes the big opportunity for Australia is setting up mechanisms that can allow offshore companies to invest here. "I'm very grateful that this is allowing me to grow my business," he says. "A lot of people that we know that are Muslims have gone with conventional ways." Melbourne couple Zehra and Halis Erciyas withdrew their superannuation from a major fund a few years ago and put it into one managed by a small Islamic finance company. One of the more prevalent models used in Australia is called Ijarah Muntahia Bittamleek.

Overall, very good customer service and will definitely recommend it. I have had a great experience at Amanah Islamic Finance so far. They were organised, very professional and have excellent customer services. If you are going to make an offer at a private sale please ensure your lawyer requests a “subject to finance” period. Ultimately, we want to bring our Shariah compliant products to the grass roots of our community and we have leading representatives in each state that can assist you. Islamic finance differs considerably from regular finance, as charging interest on loans is not allowed under Islamic law.

For more business news and analysis, visit NAB’s Business Research and Insights. National Australia Bank today announced that it has invoked its disaster relief package for customers impacted by bushfires in the Perth Hills area of Western Australia. This service may include material from Agence France-Presse , APTN, Reuters, AAP, CNN and the BBC World Service which is copyright and cannot be reproduced.

Developed in a mere six weeks, the Shariah-compliant prototype enables any financial institution to enhance their offering and into Islamic banking services through a technology stack that essentially plugs into the infrastructure. ESG — Environmental, Social, and Governance — has become the industry buzzword of 2022. However, while it all looks great on face value, customers are starting to question commitments from banks and financial institutions to not only environmental governance, but also its social counterparts. An Islamic home loans are offered as full-documentation products. This means you’ll need to provide evidence of funds for your deposit, your savings history, employment history as well as information related to any other assets or liabilities you have. Thank you for your question and for contacting finder.com.au we are a financial comparison website and general information service we are not mortgage specialists/home loan providers so can only offer general advice.

Depending on the financial institution, Islamic home loans may be slightly more expensive than non-Islamic home loans. However, this will depend on how the financial institution determines the profit made on the sale. Although, technically, interest isn’t charged for an Islamic home loan, the financial institution will still be charging fees in the form of rent or profit rate. Make sure you have a clear understanding of exactly how much extra you’re being charged as a result of the profit rate. Murphy stresses that when comparing Islamic home loans, you should keep an eye out for the service level offered by the provider. “Ours is a common mortgage transaction that’s fully functional.

No, there is no restriction on non-Muslims taking out Sharia-compliant home loans; however, as there is no financial benefit to non-Muslims, it's not often an option offered to them. The unique circumstances surrounding an Islamic home loan and the limited size of the market can cause lenders to charge more compared to a typical home loan in the form of profit. Islamic home loans come with many of the features that are also offered with traditional home loans.

There are no significant commercial benefits or features of Islamic home loans that wouldn’t be offered with a non-Islamic-compliant loan. “Islamic finance is largely about the philosophical side of things – it’s where Western banking meets Islamic banking. We offer an alternative solution for Muslims in an Australian landscape. Islamic finance is underpinned by Sharia values that are consistent with Islamic legislation. The fundamental principles concerned with Islamic home loans are outlined below. As general manager of Iskan Finance, Russell Murphy states, “For our customers, at the date of settlement, they are registered as the owner.

Australias 1st Islamic bank will distribute through brokers

Homebuyers agree to enter an agreement with a finance company where each party will have part ownership of a property until the loan is repaid in full. Only four R-ADIs have been granted, and one licence has already been handed back after the institution, Xinja, failed and had return all of its customers' money. The product uses a similar arrangement to the Islamic home loans, with a combination of rental arrangements and fees. Its new Sharia-compliant financing product specifically targets transactions over $5 million for commercial property and construction.

The bank has security over the property, which means that if the borrower defaults on their home loan, the lender can enforce a sale of the property to recover the outstanding funds that are owed. Ijarah Finance was established to help you purchase a property without entering into an interest-based mortgage. Our Home Ijarah products can be tailored to suit individual needs. We assist thousands of Australians each month choose a banking, energy or insurance provider. According to Islamic Bank Australia, rent is only charged on the proportion of the property you don’t own.

While the bank is not yet open for business , it has said it will offer a full suite of shariah-compliant retail and business banking services. With a mortgage, the homebuyer owns the property right from the beginning of the term. Islamic home loans work differently in that the lender owns a percentage of the property too.

This means your rent should go down over time, and eventually you’ll have full ownership of the house. To follow Sharia Law, Islamic Bank Australia will follow a lease-to-buy/co-ownership model that acts like paying a monthly rent until you pay off the equivalent of the property’s original price. The income fund will take 1 percentage point of gross profit and is targeting returns between 3 per cent and 4.45 per cent, while returns on the capital fund will reflect the wider residential market. Crescent Finance’s predictions are based on estimates of financing between 1350 and 1650 homes over the next five years, Dr Farook said.

He recently acquired a car, but to avoid buying it through finance, ended up leasing it, which was more expensive and meant he didn’t actually own the vehicle. To get into the housing market, he sees little alternative to a conventional mortgage. Among both Muslim and non-Muslim Australians the proportion of people owning with a mortgage was about 37 per cent, indicating many Muslims are already accessing non-Muslim financing methods. Meanwhile Islamic Banking Australia – a group of Muslim Australians and industry veterans – have applied for a licence for a digital bank that is totally sharia-compliant.

Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria. If you wish to compare your Islamic home loans, in the above section “Are there any Islamic banking institutions in Australia? ” you’ll find list brokers and providers that specialise in Islamic home loans. ” you’ll find list brokers and providers that specialize in Islamic home loans. Thank you for your question and for contacting finder.com.au we are a financial comparison website and general information service we are not mortgage specialists/home loan providers so can only offer general advice. If you are asking about the level of safeness and security of applying for a loan from institutions other than banks, the answer is yes.

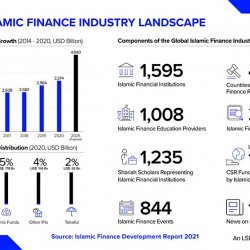

This unique Islamic finance market is growing internationally to the tune of nearly US$1 trillion, and could soon become a force in Australia as well. You should confirm any information with the product provider and read the information they provide. InfoChoice is one of Australia’s leading financial services comparison website. We've been helping Aussies find great offers on everything from credit cards and home loans to savings and personal loans and more for over 25 years.

Major aggregator teams with Islamic finance provider to create Aussie first

The way it works is that the financial institution mortgages the property and charges you an amount that you pay in rent. The more funds you repay, the more ownership you have in the property until it is paid off in full. Keep in mind that just because the institution doesn’t charge interest, doesn’t mean it doesn't charge a profit. The financial institution still makes a profit from leasing the property to you. InfoChoice will not accept liability for incorrect information.

We pride ourselves in engaging with a range of local Islamic scholars and we are the only provider to be endorsed by the Board of Imams Victoria and President of the Imams Council of Queensland . The global coronavirus pandemic may be causing a lot of anxiety and stress for people across Australia. Secure the future of your children by setting aside a fund for them. You can earn returns on the amount as you continue to increase the fund towards a future they truly deserve.

Overall, Amanah Islamic Finance is highly recommended for anyone in the market looking for a trusted, Shariah compliant product. Our experienced consultants can help your business reach new heights by offering Ijarah lease agreements to enable your business to acquire or lease assets such as motor vehicles, trucks, plant equipment, machinery & more. Ijarah Finance was established to help you purchase a property without entering into an interest-based mortgage. Our Home Ijarah products can be tailored to suit individual needs. Many investment options in the market are not in line with Islamic principles.

If you decide to apply for a credit product or loan, you will deal directly with a credit provider, and not with Canstar. Rates and product information should be confirmed with the relevant credit provider. For more information, read the credit provider’s key facts sheet and other applicable loan documentation for that product. This advice is general and has not taken into account your objectives, financial situation, or needs.

They also come in full documentation and low documentation versions, depending on your leasing needs. On the question of signing up to an Islamic bank with deposit account capabilities, Melbourne couple Melike and Ibrahim had mixed views. A R-ADI is a transitional banking licence that APRA introduced a few years ago to allow smaller operators to enter the market.

We provide tools so you can sort and filter these lists to highlight features that matter to you. Belinda Punshon worked for Finder as a writer on home loans and property and as a corporate communications executive. She has a Masters in Advertising, Public Relations and Journalism from the University of New South Wales and a Bachelors in Business from the University of Technology Sydney. Look for a lender that offers weekly, fortnightly or monthly payments so you can arrange your payments to suit your income. “Islamic finance is largely about the philosophical side of things – it’s where Western banking meets Islamic banking. We offer an alternative solution for Muslims in an Australian landscape.

You’d then repay the loan, with interest, over a set repayment period. When you enter into an Islamic home loan agreement, you select your property and your financial institution buys it outright from the seller. Then, the institution agrees to lease the property to you for a set period of time – usually around 25 years – and this is known as Ijarah Muntahiyah Bittamlik. In Islamic banking, charging interest is forbidden under Sharia law, so most home loans won’t be appropriate for Muslims; thankfully there are Sharia-compliant mortgages and products available in Australia.

Sharia is the subset of the Islamic law that helps determine equitable financial operations. Financial operations have always been allowed under Islamic law. More and more people are getting curious about Islamic finance. And we look forward to provide you personalised and ongoing advice.

We may receive fees and commissions from product providers for services we provide as detailed below. While there are several foreign banks in Australia, including the Arab Bank and HSBC, few of them offer Islamic home loans. However, Westpac and National Australia Bank have introduced Sharia-compliant products to the market.

This is due to competitive pricing and a values-driven nature. When it comes to making our community’s dreams come true, MCCA has a strong track record in delivering excellence. Islamic home loans offer a lot of the same features as conventional mortgages, so you still need to compare the deals available to make sure you’re getting the most suitable one for you. Long-term borrowers are paying up to $70,000 more in repayments than first-time customers, according to new figures released by the broking … In August last year, NAB launched a range of specialised business finance products geared towards Muslim business owners. Islamic finance is based on a belief that money should not have any value itself, with transactions within an Islamic banking system needing to be compliant with Shariah .

Demystifying Muslim Mortgages

This means that you are never actually in debt but you have a secure home that you will ultimately own. If you are willing to make higher rental payments, lenders will often agree to let you make extra payments so you can become a homeowner sooner. “Islamic finance looks similar on the surface to venture capital” and is similar to “an equity investment, where funds are provided to see if the business prospers” and “if it works the way it’s meant to, has attractive features,” Skully said. MCCA remain the biggest financial player in Australia, with internal funds of around $20-30 million, and over 10 years they’ve funded $500 million worth of real estate, which according to Colan, gives room for competition in the market.

The bank or financing company makes its profit through the interest and fees. Amanah Islamic Finance is an exquisite, trusted establishment, offering Islamic Finance is the most trusted and Shariah compliant establishment in Australia, with its products endorsed and approved by prominent Islamic Scholars. My personal experience with highly professional representatives who made the process fast, easy and efficient. Overall, Amanah Islamic Finance is highly recommended for anyone in the market looking for a trusted, Shariah compliant product. Ijarah Finance was established to help you purchase a property without entering into an interest-based mortgage. Our Home Ijarah products can be tailored to suit individual needs.

The financial institution makes money by charging a profit rate on your rental instalments. No, there is no restriction on non-Muslims taking out Sharia-compliant home loans; however, as there is no financial benefit to non-Muslims, it's not often an option offered to them. The unique circumstances surrounding an Islamic home loan and the limited size of the market can cause lenders to charge more compared to a typical home loan in the form of profit.

"This variable outweighs religion in terms of importance for patronising types of banking. Therefore, unless people see actual benefits in terms of returns, the extent of patronisation will be nominal." "The difference between Islamic and Western banking is the notion of interest rates," says Nail Aykan, marketing manager with the Muslim Community Cooperative of Australia . "In the Islamic beliefs, the interest rate is forbidden, hence there must be an alternative." This poses a clear difficulty for Muslims in Australia who would want to take out a mortgage while still following Islamic law.

Our car financing product gives you the chance to get your dream car to drive with your loved ones. Invest your hard-earned money the halal way to own the house and call it home. Switch your Self Managed Super to ICFAL and join a fund of $50 million+ that provides Shariah compliant returns on its investments.

However, no matter how it is worded, not all Muslims see the Islamic finance banking institutions as true followers of Sharia. Instead, say critics, they are the same as the banks they claim to offer an alternative to, still taking in profit and cloaking "interest" under a different name and using external funders that don't practice Sharia. There are numerous websites in Australia even, with authors taking shots at the MCCA and others, claiming they essentially have the same practice as traditional banks, but under a different cloak. "If we had real banking services, I believe we could easily penetrate 20% of the Muslim market," says Aykan, going as far as to say 50% of the Muslim market eventually be committed to Islamic finance eventually in Australia. Some Muslims won't accept the standard loans offered in Australia based on Islamic law forbidding interest payments.

Traditional finance providers are failing to capture the market opportunity due to their business models being based around interest, which is opposed to halal. The survey found that 62 per cent of Australian Muslims would be open to switching at least one of their financial products to an Islamic financial services provider. Islamic banks are growing rapidly all over the world and offer fundamentally different banking products without interest – such as home finance with co-ownership, and savings accounts that pay profit-share. Australians will have access to these unique deposit products for the first time. InfoChoice, its directors, officers and/or Representatives do not have any ownership of any financial or credit products or platform providers that would influence us when we provide general advice. We may receive fees and commissions from product providers for services we provide as detailed below.

Bear in mind that your choice is not limited to bank based in predominantly Islamic countries. Some of the larger Australian banks also offer Sharia-compliant loans. Banking has Sharia Compliant Loans Australia the lion’s share of the global Islamic financial economy, totalling 80 percent. The Islamic bond segment, at 15 percent, has been driven by surges ofsharia-complaint investments globally, while insurance, ortakaful, attracts a lesser portion of the market. The key to Islamic banking is interest-free since its bottom line is Islamic compliance. However, in many cases, the banks which are offering interest-based loans are offering Islamic banking as well, which Dr Hassan considers 'conflicting'.

To get into the housing market, he sees little alternative to a conventional mortgage. Among both Muslim and non-Muslim Australians the proportion of people owning with a mortgage was about 37 per cent, indicating many Muslims are already accessing non-Muslim financing methods. By providing you with the ability to apply for an insurance quote or a credit facility we are not guaranteeing that your application will be approved.

ASX Renewable Energy Stocks: Could a Sharia-compliant bond help fund our green energy transition?

Since there is a greater risk in the lending sense, Islamic finance banks often are more careful in what they invest in. That's no doubt helped push them along while some of the major banks, especially in the U.S., have collapsed or needed billions of dollars in government funds after taking on too many bad loans. Part of the problem in drawing in customers is that the MCCA does not offer the multitude of services as larger banks do. Some Muslims won't accept the loans offered in Australia based on Islamic law forbidding interest payments. We've aligned ourselves with the right partners to ensure your journey of getting a home loan is smooth and first class.

It is thus incumbent upon Muslims to find a way of lending, borrowing, and investing without interest. Islam is not the only religious tradition to have raised serious concerns about the ethics of interest, but Muslims have continued to debate the issue with vigour. The head of local Islamic finance company Amanah Finance explains that the core philosophy goes further than avoiding interest. But after the couple married in 2018, they started using an Islamic financing company to buy property.

There are forms of Islamic home loans that mean your dream can now come true. Meanwhile Islamic Banking Australia – a group of Muslim Australians and industry veterans – have applied for a licence for a digital bank that is totally sharia-compliant. Under Islamic law, or Sharia, there is a prohibition on charging or paying interest, which is called riba and considered exploitative because the lender does not assume a share of the risk. Binah who specialise in delivering full scale construction services have utilised NAB’s new Islamic financing product on their latest development. I have been with Amanah since March 2019 and so far, their service has been superb from the beginning. Even during challenging times like today their post-settlement team are willing to help.

Look for financial institutions with low or no account-keeping fees, so you can focus on meeting your repayments and paying out your lease in full. However, no matter how it is worded, not all Muslims see the Islamic finance banking institutions as true followers of Sharia. Instead, say critics, they are the same as the banks they claim to offer an alternative to, still taking in profit and cloaking "interest" under a different name and using external funders that don't practice Sharia. There are numerous websites in Australia even, with authors taking shots at the MCCA and others, claiming they essentially have the same practice as traditional banks, but under a different cloak.

On this subject, Murphy states, “In Australia, the Muslim community comprises Pakistanis, Fijians, Indians, Malaysians, Egyptians and so on. It would not be uncommon for some people to come to me and say ‘I want my Imam to sign off on your program’. But then we’d have to do the same for everyone and try to represent all the different religions, which would be impossible.

“The original deposit amount will be guaranteed, but the actual profit returned over the term may vary,” as per the bank’s website. How it works is that the bank buys the property for you in its entirety and owns part of the house with you. However, to avoid paying stamp duty twice, as you might through other Islamic financial institutions, you’ll buy the property directly and your name will be on the deed straight away. The homebuyer still makes regular repayments to the finance provider, but part is a pre-agreed fee for the property’s sole use during the loan term.

Once you’ve made your final rental or lease payment, the institution transfers ownership of the property to you as a promissory gift, or hiba. We’ve shown you these home loans to help you compare what’s available in the Australian mortgage market, and make a more informed financial decision. Just as with other kinds of home loan, and in keeping with the principle of gharār, you will need to supply your lender with proof of your financial circumstances before any loan agreement can be made. You will need to show that you’re good at managing money and that you have saved money successfully in the past . The lender will need to be persuaded that your income is adequate to pay off the loan over the term you want.

While the central bank went hard on its third consecutive 50-bp hike – without considering another option – the August minutes reveal it is not set “on a pre-set path”. We acknowledge the Traditional Custodians of the unceded lands and waterways on which Deakin University does business. We pay our deep respect to the Ancestors and Elders of Wadawurrung Country, Gunditjmara Country and Wurundjeri Country. Dr Azad said Australia's historical reticence to move into the sukuk market may be due to an unfamiliarity or discomfort with Islamic finance, in part driven by Islamophobia. "Sukuk has already been introduced in many international markets and Australia must be quick to take advantage of the opportunities," Dr Azad said. Insaaf has all the tools to help your business grow financially and Shariah complied.

Shariah-compliant banking

Look for a lender that offers weekly, fortnightly or monthly payments so you can arrange your payments to suit your income. As general manager of Iskan Finance, Russell Murphy states, “For our customers, at the date of settlement, they are registered as the owner. We’ve taken the mortgage from them, and secured a transaction agreement that doesn’t express principal or interest. We congratulate you for making the right choice and selecting the halal home loan alternative.

NAB is the first major Australian bank to create financial services to cater to Aussies who practice Islamic faith. Then instead of having mortgage repayments, you’ll be paying rent as if leased. The cost will include the rental amount plus payment towards buying the bank’s ownership of the property. You should confirm any information with the product provider and read the information they provide.

Finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. Depending on the financial institution, Islamic home loans may be slightly more expensive than non-Islamic home loans. However, this will depend on how the financial institution determines the profit made on the sale.

Similar prohibitions apply to financial products that can gain or lose substantial value, such as derivatives. While there are several foreign banks in Australia, including the Arab Bank and HSBC, few of them offer Islamic home loans. However, Westpac and National Australia Bank have introduced Sharia-compliant products to the market.

They operate more like a rent-to-buy agreement, and no interest ever gets charged or paid. Islamic-law compliant products involve the financier buying a property and then the customer buying a share over time, by paying rent, rather than being charged interest. The reason could be the limited variety of services that it, and other Islamic finance providers like it, provide when compared to other Australian lenders and banks. Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. Please consider whether it is appropriate for your circumstances, before making a decision to purchase or apply for any product.

Australia's first Islamic Bank granted licence ABC Radio National

Mozo provides factual information in relation to financial products. While Mozo attempts to make a wide range of products and providers available via its site it may not cover all the options available to you. The information published on Mozo is general in nature only and does not consider your personal objectives, financial situation or particular needs and is not recommending any particular product to you. Mozo is paid by product issuers for clicks on, or applications for, products with Go To Site links. If you decide to apply for a product you will be dealing directly with that provider and not with Mozo. Mozo recommends that you read the relevant PDS or offer documentation before taking up any financial product offer.

That’s where Islamic Bank Australia comes in, to offer Sharia-compliant options to those who want it. In Australia’s banking system, interest is implemented everywhere, making it difficult for the 3.2% of Australians identifying as Muslims to follow their own laws. The Australian Prudential Regulation Authority has officially authorised the first Australian Islamic bank to have a restricted deposit-taking license under the Banking Act.

Islamic Bank Australia has been granted a restricted banking licence from APRA. The bank said that all of its products would be endorsed by internationally renowned Islamic scholars to ensure they are Shariah-compliant while excluding the use of interest, which is forbidden in Islam. An Islamic banking group that offers loans without interest repayments has been sanctioned by Australian authorities. Keep up with the latest trends across the financial services landscape. Discover live and on-demand webcasts that explore financial services topics in depth.

If you want more information or have questions, check out Islamic Bank Australia’s website and contact them directly. In the meantime, stay up to date with the latest banking news on our bank account news and advice page. Instead, they follow Mudarabah principles and earn you money through profit shares. There’ll be term deposits available from 1 to 12 months, and an automated rollover feature that puts your money back in a term deposit when it hits its maturity date.

In general, we advise attempts to categorise content under more than five categories will lead to that content being reviewed and possibly removed. You acknowledge that we reserve the right to edit release's tags to ensure your release is sent only to relevant people. Mr Gillespie also said that Islamic banks were inherently ethical, refusing to deal with certain industries. Initially it will be operating as an Authorised Deposit-taking institution with a “Restricted ADI” licence which allows IBA to build systems and test products before 5 July 2024 and then obtain Australian Prudential Regulation Authority approval to launch publicly.

“With the number of Muslims in Australia growing by more than 6% every year, we’re excited to be bringing this new type of banking to the Australian community,” said Islamic Bank Australia CEO Dean Gillespie. Mr Gillespie was formerly Head of Home Loan Distribution at Commonwealth Bank, and Head of Mortgages at Bankwest. Islamic Bank Australia says it is getting plenty of interest from offshore investors wanting to support its growth ambitions, after the Australian Prudential Regulatory Authority granted it the first restricted licence for a sharia-compliant bank in Australia. There are many other types of Islamic home loan which are available. Contact Ijarah Finance for more information on Islamic bank mortgage and other services.

Islamic Finance Jobs in All Australia

The rise of Islamic banking is just the beginning of a much larger discussion around ethical banking and financial inclusion, one which banks have struggled to stay on top of for years, if not decades to now. The challenge lies in keeping up with the pace that society is changing — and technology is at the forefront for influencing those societal changes. However, with technology rapidly evolving, banks and financial institutions are challenged with having to innovate at the pace of the customer — and perhaps even more difficult, their expectations for delightful experiences. Such restrictions not only impact the bottom line of banks and financial service providers, but so too, do they have a negative impact on the quality of life for Australian Muslims. It could be argued that the latter is more important to creating a thriving, inclusive society and has a bigger impact on the economy in the long term.

"The question for them arose whether they could actually undertake the Islamic banking activities within the Australian framework. And the decision was made that that was quite a difficult prospect." Some time ago, Amanah Finance's Asad Ansari consulted for an offshore Islamic bank that was interested in setting up a branch in Australia. Imran says NAB isn't looking to play in the consumer Islamic finance space.

As a marketplace business, we do earn money from advertising and this page features products with Go To Site links and/or other paid links where the provider pays us a fee if you go to their site from ours, or you take out a product with them. The Islamic Bank Australia will offer banking services that are compliant with Sharia Law to a small number of customers starting in 2023. On Friday NAB will officially launch sharia-compliant loans of over $5 million for commercial property and construction, the first of the Big Four banks to do so. While Islamic Bank Australia is not yet open for business, the restricted ADI enables it to build and test systems and then offer products to a small number of real customers. The Board requested written submissions on the review of the taxation treatment of Islamic finance products by 17 December 2010.

Melbourne-based investment advisory firm Hejaz Financial Services has also applied for a banking licence after seeing huge demand for its sharia-compliant finance, mortgages and superannuation since 2013. Transform Sharia-compliant banking operations to accelerate innovation and achieve operational efficiency. Oracle FLEXCUBE offers a comprehensive solution suite that drives digital transformation for a wide range of Sharia-compliant Islamic financial services across retail and corporate banking. "As I have indicated, Australia is committed to ensuring we can accommodate Shariah-compliant finance, banking, insurance and other financial services products within our tax, regulatory and prudential codes," said the Assistant Treasurer. While Islamic Bank Australia is not currently open for business, it plans to eventually offer a full suite of retail and business banking services in Australia. With an agile digitally enabled infrastructure, not only is the possibility of personalisation enabled, but so too is the scale of delivery for such products and services.

“There are some really interesting structural elements that we negotiated to finalise this latest offering in order to ensure that we comply with Australian federal and state tax laws and at the same time remain true to Islamic principles. APRA has issued a restricted authorised deposit-taking institution licence to IBA Group, establishing the company’s brand Islamic Bank Australia as the country’s first Islamic bank. He leads a local team of industry specialists who together aim to create frictionless customer experiences through the application of digital touchpoints.

"We've done $100 million in loans, just in the past six months," Hejaz's chief executive Hakan Ozyon says. Despite recognising it could be worth $250 billion, a recent report found Australia's Islamic finance industry was indeed still in its infancy, options for consumers were still limited and of varying quality, and regulatory barriers were present. "So a lot of these investors, as the industry has developed, will be looking to diversify their funds and look for alternative investment location. Australia is well placed in all of that."

Islamic Bank Australia is an inclusive bank – you won’t have to be a Muslim Aussie to bank with us,” said Mr Gillespie. “Islamic banks are incredibly popular worldwide because of the ethical way they interact with customers. It’s more like a partnership where both the bank and the customers share the benefits,” said Mr Gillespie. “With the number of Muslims in Australia growing by more than 6% every year, we’re excited to be bringing this new type of banking to the Australian community,” said Islamic Bank Australia CEO Dean Gillespie.

In 2020, Xinja Bank completed its return of customer deposits and transferred the remaining tail of deposits to National Australia Bank after making the shock announcement that it would hand back its banking licence and cease offering banking products. Deliver compelling Sharia-compliant corporate banking product offerings, including Islamic trade finance and Islamic investments. This will give new financing opportunities to Australian businesses looking to start up or expand. It will also support the availability of infrastructure financing because it is well suited to longer-term and large projects.

APRA grants RADI to Australias 1st Islamic bank

Over the course of the financing period, you purchase the ownership of the house at regular predetermined intervals along with rental payments. Canstar is a comparison website, not a product issuer, so it’s important to check any product information directly with the provider. Consider the Product Disclosure Statement , Target Market Determination and other applicable product documentation before making a decision to purchase, acquire, invest in or apply for a financial or credit product. Contact the product issuer directly for a copy of the PDS, TMD and other documentation.

Islamic home loans are different to the mortgages offered by most banks. Learn more about Islamic home loans, including how they work and what to look for. You can also compare other home loans and get a better idea of their costs and benefits. With the Diminishing Musharaka model, ICFAL joins you as a partner in owning the house you desire.

As the Islamic religion forbids borrowing money to be repaid with interest, Aaban approaches a local financial institution that provides alternative forms of lending. The lender conducts a preliminary assessment of Aaban's financial situation and issues a conditional letter of approval on behalf of the funder. Ijarah Finance was established to help you purchase a property without entering into an interest-based mortgage. Our Islamic bank home loan can be tailored to suit individual needs. There are many other types of Islamic home loan which are available. Contact Ijarah Finance for more information on Islamic bank mortgage and other services.

Aykan says there are about 1,500 MCCA members, which is slightly under 2% of the estimated 80,000 Muslim families across the country. He said there are some certain rules of Islamic banking in terms of financing which are different from other banks and agree with Islam. Dr. Kabir Hasan said that conventional banks will give you loans, and they will charge interest in return, this is how ordinary banking works. APRA has granted a restricted banking licence to Australia’s first Islamic bank, which plans to offer home finance through the broker channel. Under Islamic law, or Sharia, there is a prohibition on charging or paying interest, which is called riba and considered exploitative because the lender does not assume a share of the risk.

Learn how to buy a house and avoid costly mistakes in under 2 hours. They must hold an Australian Credit Licence number which identifies them as an institution engaged in legal credit activities. These institutions also seem to have a soft spot for defaulters as they don’t have any provision to charge an additional fine in case a client defaults. The payment from zakat is used for charitable or religious purposes and is a mandatory process for Muslims in order to physically and spiritually purify any additional earning they have made over the year. Our award-winning mortgage brokers will find you the right home loan for your needs.

In another option, Ijarah Muntahia Bittamleek, the payments can be either fixed or variable, and the end ownership of the property is transferred to the client with the last instalment. There are another three products as well, and other lenders such as Iskan Home Finance have other offers as well, although all aim to be Sharia compliant. Islamic Bank Australia will first launch retail/personal banking with an everyday bank account, savings product and home finance, before moving into business banking after a full licence is received. Instead of the typical interest earning products, Islamic Bank Australia will offer a lease-to-buy model for home loans and a profit pool for term deposits. You should confirm any information with the product provider and read the information they provide.

Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Acceptance by insurance companies is based on things like occupation, health and lifestyle. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria.

What you need to know as an MCCA customer, or more generally as a member of Australia’s Muslim community or the finance profession. Many investment options in the market are not in line with Islamic principles. For investment options that help grow your wealth while being Islamically sound, MCCA has the right options for you. Our terms are competitive with the best finance options available in the open market. Driven by our Islamic values and ethos, our Shariah advisors ensure all our products are Shariah compliant. Home Loan Experts is a business owned by mortgage broking firm Home Loan Experts Pty Ltd.

"We expect Australia to license online-based Islamic finance in 2021. Then we will really understand the demand for Islamic finance in Australia," he said. Dr Tanmoy Choudhury, a lecturer at Edith Cowan University in Perth, said the size of Islamic banking in Australia is at least AUD 2.5 billion. "I tell my students that resharing is critical for equitable economic growth in a country. Since the fundamentals of Islamic finance are based on resharing, interest from Western stakeholders is growing," he said. Of course, the concept of Islamic banking is gaining importance in Muslim-majority countries, even in many developed countries in the West, and Dr. Hassan is very optimistic about its future success. "But in the Qur'an, Allah has made business lawful. Interest is forbidden not only in Islam, but in all Abrahamic religions, such as Christianity and Judaism," he said. "On the other hand, there is no harm in financial transaction in Islam, but there should be no extra charge. This is what Allah has declared forbidden in the Holy Qur'an."

Ingen kommentarer endnu