islamic finance halal loans sharia finance australia

Let me assure you the Government is intent on developing Australia as a regional financial centre and it sees Islamic finance as a fundamental part of that endeavour. Businesses that offer Islamic finance products should benefit from any successes we achieve in that sphere. First, the Report recommends the removal of regulatory barriers to the development of Islamic finance products in Australia. While our finance and insurance sector already generates significant jobs and wealth, we recognise that it has a great untapped potential. This outcome provides tentative signs that a self-sustaining private sector recovery is in prospect, although growth still relies on public infrastructure investment. In looking at the future of Islamic finance I think it is first necessary to talk about the state of the Australian economy and how the Government is positioning Australia to be a regional financial centre.

Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. Generally, the financial institution will need you to supply proof of your income and ability to meet your rental payments, proof of funds to complete the deposit as well as a minimal rental deposit if you intend to live in the home. In most cases, you are offered the same features as a typical home loan. Some of these help you in achieving property ownership sooner, while others can give you the option of lower payments if you make lease payments only. The LVR ratio refers to the amount of the property value or purchase price you can borrow from the lender. A loan with a high insured LVR allows you to borrow funds without paying lenders mortgage insurance .

After considering the views of all stakeholders the Board was requested to provide a final report to the Assistant Treasurer by June 2011. Information on this website does not take your personal circumstances, needs or objectives into account. We do not currently meet the full prudential framework and/or requirements, and you should consider this before depositing funds with us.

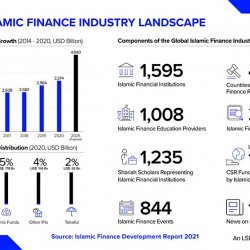

"The existence of recognised and regulated super-funds that invest according to Islamic Finance principles is hence a welcome advancement, as it lessens such constraints," he says. Australia is among the nations in which Islamic Finance is growing most rapidly. This is according to the recently released Islamic Finance Development Report 2018, compiled by Thomson Reuters and the Islamic Corp for the Development of the Private Sector. The report shows a global annual growth of 11 per cent in 2017 to more than US $2.5 trillion in assets. Adhering to Islamic principles, Islamic Finance is growing in Australia and could contribute to the non-Muslim community and economy, not to mention boost the workforce and improve social inclusion.

This paper explores the nature and extent of financial exclusion of Muslim community in Australia. Adopting a survey questionnaire method primary data has been used, and Queensland is the selected state for this exploratory case study. While nearly 3 billion people in the world face difficulties in accessing formal financial services and products, in Australian alone, approximately 3.1 million of the adult population are identified as being financially excluded. There is still a lack of information about financial exclusion according to ethnicity or religious group in Australia.

We pride ourselves in engaging with a range of local Islamic scholars and we are the only provider to be endorsed by the Board of Imams Victoria and President of the Imams Council of Queensland . Ijarah Finance operates under the principle of Rent-To-Own otherwise known as Ijarah Muntahiya Bil Tamleek – A Lease Agreement with the option to own the leased asset at the end of the lease period. If the idea of owing your own property, vehicle or equipment via Ijarah appeals to you but you are currently paying off an existing mortgage we can help you replace it. Purchase a rural property without engaging in an interest-based contract. There are four different types of equipment or asset finance structures that your business can utilize in order to acquire assets such as vehicles, machinery and business equipment. Invest your hard-earned money the halal way to own the house and call it home.

Most of what is happening is positive and constructive, with local firms setting up Islamic finance specialist units to take advantage of the opportunities this one-trillion-dollar sector offers. Visiting Manama, Bahrain on a visit to the Gulf, the Assistant Treasurer met with the Central Bank of Bahrain and key government economic and banking officials. According to Tani, the existence of such recognised and regulated Islamic financial products will have positive consequences for the whole Australian society. And it could also affect their participation as members of the Australian workforce.

We’re working as fast as we can to achieve our full ADI licence and bring our products to the Islamic community and all Australians,” Mr Gillespie said. The report concluded Australia has arguably the most efficient and competitive financial sector in the Asia-Pacific region, but there are further opportunities to expand our exports and imports of financial services. Australia is highly regarded internationally as a place to do business.

The consultation meetings were attended by representatives from taxation professional bodies, major law and accounting firms, various major corporations and business associations. Open your account instantly through the app anywhere across Australia. Transfer funds between banks in real-time using the New Payments Platform . Binah who specialise in delivering full scale construction services have utilised NAB’s new Islamic financing product on their latest development.

Saving People from Riba

Home loan applications continue to decline, according to the latest Equifax data. Without this approach, the gap on financial inclusion will only widen or contribute to diminishing financial health. IBA's licence is timely too, with the 2021 Australian Census highlighting a 34.6 per cent increase in Australia’s Islamic population — now the second largest religion in our country. We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

We provide tools so you can sort and filter these lists to highlight features that matter to you. Get a cash lump sum of $2,000+ for refinancing to a low-rate loan. Your lending institution may approve your circumstance beforehand, allowing you to immediately choose a home that is within the price range they agreed upon, thereby facilitating your application process. This alternative method of obtaining a home is designed to better align with Sharia law to offer Muslims a means of pursuing home ownership without offending their religious values. Look for a lender that offers weekly, fortnightly or monthly payments so you can arrange your payments to suit your income. The property he'd like to purchase is valued at $310,000 and with his $60,000 deposit, he needs help coming up with the $250,000 difference before the house can be transferred to him.

"We've recognised that the Islamic finance industry has grown at a rate of about 15 per cent since the 1990s," NAB's director of Islamic finance, Imran Lum, tells ABC News. But in the past decade, he has been taking out more Islamic loans, including one just a few months ago to expand his company's meat-processing ability. Yet, despite making an Australian gastronomic icon, over the years the small business owner has felt excluded from the country's financial system and investment opportunities. The couple also intentionally avoids mainstream interest-based loans. When they wanted to buy a new car, they saved up and bought it outright. The complication in the Australian context is that laws aren't set up for this style of lending, so technically the home is owned by the household from the beginning, but with a legal agreement that the Islamic lender is entitled to it.

But after the couple married in 2018, they started using an Islamic financing company to buy property. They've now flipped three houses, all using the same financier. With roughly 600,000 people identifying as Muslim in Australia, industry reports place the potential size of this market in Australia at $250 billion. We are a Restricted ADI and do Halal Car Finance not yet meet the full prudential framework, and you should consider this before banking with us once we are open for business. Information on this website does not take your personal circumstances, needs or objectives into account.

He leads a local team of industry specialists who together aim to create frictionless customer experiences through the application of digital touchpoints. Earlier this year, our digital engineering team at Mobiquity delivered an Islamic bank prototype with online car finance ("Murabaha") to support the growing global Muslim community. I’m afraid we may not be able to provide you with an answer to that question. The accounting treatment will be determined by the lender/bank that offers the Islamic Home Loan.

"One of the great things about Australia is we live in a nation where so many different people from different cultures or different religious backgrounds, or even no religion at all, can get on." "The question for them arose whether they could actually undertake the Islamic banking activities within the Australian framework. And the decision was made that that was quite a difficult prospect." Imran says NAB isn't looking to play in the consumer Islamic finance space.

Depending on the financial institution, Islamic home loans may be slightly more expensive than non-Islamic home loans. However, this will depend on how the financial institution determines the profit made on the sale. Although, technically, interest isn’t charged for an Islamic home loan, the financial institution will still be charging fees in the form of rent or profit rate. Make sure you have a clear understanding of exactly how much extra you’re being charged as a result of the profit rate. Murphy stresses that when comparing Islamic home loans, you should keep an eye out for the service level offered by the provider. “Ours is a common mortgage transaction that’s fully functional.

Over time, the client pays off the house through rental payments, which include a profit to the financier and reflect market interest rates. Eventually, the asset is wholly paid off by the client and they own the house outright. Fees and charges may apply, as well as terms and conditions which you should review. In order to open a credit product in future, you will need to meet our credit criteria and be approved. Please review the product disclosure documentation provided at the time of opening your account for detailed information.

There are no significant commercial benefits or features of Islamic home loans that wouldn’t be offered with a non-Islamic-compliant loan. “Islamic finance is largely about the philosophical side of things – it’s where Western banking meets Islamic banking. We offer an alternative solution for Muslims in an Australian landscape. Islamic finance is underpinned by Sharia values that are consistent with Islamic legislation. The fundamental principles concerned with Islamic home loans are outlined below. As general manager of Iskan Finance, Russell Murphy states, “For our customers, at the date of settlement, they are registered as the owner.

Saving People from Riba

If you are going to make an offer at a private sale please ensure your lawyer requests a “subject to finance” period. Ultimately, we want to bring our Shariah compliant products to the grass roots of our community and we have leading representatives in each state that can assist you. We have now provided more than $300 million of Islamic finance to customers nationally and our presence has grown across Australia with representatives in each state. Our Low Doc products may be the perfect solution for self-employed business owners who do not have the standard financials.

“Looking to get secure sharia-compliant finance is quite hard,” Mr Karolia said. Chief operating officer Muzzammil Dhedhy, a qualified cleric and Islamic theologian, says Islamic laws govern all aspects of Muslims’ lives and many will not feel comfortable dealing with a conventional bank. Chief executive Dean Gillespie says the bank already has a customer waiting list of 5000 and hopes to open next year.

Islamic finance might be relatively new to Australia, but it’s an important part of the Islamic belief system and has existed for as long as the religion itself. And at the big end of town, one of the country's largest banks, NAB, is launching a specialised financing product for Islamic business customers, which the company believes is an Australian first for banking. Interest-based home loans that dominate our market generally allow people to borrow money from a bank, buy a house with that cash, and then pay the money back over a fixed term to the financier with interest. Canstar is an information provider and in giving you product information Canstar is not making any suggestion or recommendation about a particular credit product or loan. If you decide to apply for a credit product or loan, you will deal directly with a credit provider, and not with Canstar.

You will need to show that you’re good at managing money and that you have saved money successfully in the past . The lender will need to be persuaded that your income is adequate to pay off the loan over the term you want. Bear in mind that your choice is not limited to bank based in predominantly Islamic countries. Some of the larger Australian banks also offer Sharia-compliant loans.

National Australia Bank today announced that it has invoked its disaster relief package for customers impacted by bushfires in the Perth Hills area of Western Australia. This service may include material from Agence France-Presse , APTN, Reuters, AAP, CNN and the BBC World Service which is copyright and cannot be reproduced. "One of the great things about Australia is we live in a nation where so many different people from different cultures or different religious backgrounds, or even no religion at all, can get on."

Income could be an upfront commission and/or ongoing commission. The commission depends on the amount of the finance, cost of the product or other factors and may vary from product to product. Australia's Islamic bank offering Shariah-compliant banking services including everyday banking, savings products and home finance. We are a Restricted ADI, and are still building our systems and processes.

I live in interstate and I had all the communication with them either over the phone or via email. I faced no difficulty dealing with Insaaf and the financing process was very smooth. And we look forward to provide you personalised and ongoing advice. Dr Imran Lum, Director Islamic Finance in NAB’s Deal Structuring and Execution team said; “We’re really proud to be able to offer such a valuable service to Australia’s Muslim community. On the question of signing up to an Islamic bank with deposit account capabilities, Melbourne couple Melike and Ibrahim had mixed views. "We've done $100 million in loans, just in the past six months," Hejaz's chief executive Hakan Ozyon says.

Major aggregator teams with Islamic finance provider to create Aussie first

"We've done $100 million in loans, just in the past six months," Hejaz's chief executive Hakan Ozyon says. "Getting a banking licence is a fairly challenging thing to do in any case, but trying to start an Islamic bank in a country where almost nothing is set up to support Islamic banking is really challenging," he says. "The question for them arose whether they could actually undertake the Islamic banking activities within the Australian framework. And the decision was made that that was quite a difficult prospect." Some time ago, Amanah Finance's Asad Ansari consulted for an offshore Islamic bank that was interested in setting up a branch in Australia. Imran says NAB isn't looking to play in the consumer Islamic finance space.

However, you must consider additional concepts such as risk-sharing and the absence of ambiguity which make Islamic home loans unique, compared to traditional loan products. On this subject, Murphy states, “In Australia, the Muslim community comprises Pakistanis, Fijians, Indians, Malaysians, Egyptians and so on. It would not be uncommon for some people to come to me and say ‘I want my Imam to sign off on your program’. But then we’d have to do the same for everyone and try to represent all the different religions, which would be impossible. InfoChoice, its directors, officers and/or Representatives do not have any ownership of any financial or credit products or platform providers that would influence us when we provide general advice.

It is not personal advice, and you should not rely on it, even if the example is similar to your own circumstances. An Islamic home loans are offered as full-documentation products. This means you’ll need to provide evidence of funds for your deposit, your savings history, employment history as well as information related to any other assets or liabilities you have. However, according to Ernst & Young, Islamic banking assets have experienced rapid growth and are forecast to increase by an average of 19.7% a year until 2018.

An identity that captures and expresses our values, product, and promise to a better community. Thoroughly screened products with strict adherence to Islamic principles. Access our Tools & Resources to help you with your Islamic financing and investments journey.

They also come in full documentation and low documentation versions, depending on your leasing needs. On the question of signing up to an Islamic bank with deposit account capabilities, Melbourne couple Melike and Ibrahim had mixed views. A R-ADI is a transitional banking licence that APRA introduced a few years ago to allow smaller operators to enter the market.

He believes the big opportunity for Australia is setting up mechanisms that can allow offshore companies to invest here. "I'm very grateful that this is allowing me to grow my business," he says. "A lot of people that we know that are Muslims have gone with conventional ways." One area the sector is tapping into – with some logistical wrangling – is consumer home loans, like those taken out by Melike and Ibrahim.

With a 30+ year track record, we provide a compelling Islamic finance option for the Muslims of Australia.

“It’s the flexibility of the link between those two funds that should be attractive – a choice of income or capital, drawing on the benefits of both,” Dr Hewson said. The data, which is derived from a June survey of 1,002 broker customers and conducted by Honeycomb Strategy,… Hejaz Financial Services has been active in Australia for over a decade and assists Muslims in making various aspects of Australian finance, such as Supers and Investment, compliant with their religious beliefs. You’ll receive the latest industry news, tips and offers straight to your inbox. Many of our members are hard-working Muslims, who have been looking to earn a flexible income by becoming rideshare drivers.

Most Sharia-compliant institutions offer pre-approval so you know the price bracket to concentrate on before actually applying for the mortgage. “There’s now an opportunity to use our Islamic banking to extend culturally ethical banking services that delight and exceed expectations of customers,” Mr Quiroga said. Sharia law prohibits interest from being paid or earned, to avoid profit being made, meaning that traditional loan products may not be an option for Muslim borrowers. We’ve shown you these home loans to help you compare what’s available in the Australian mortgage market, and make a more informed financial decision.

It complies with Islamic law and serves a function similar to a bond. It refers to gambling, which is illegal for the same reasons as Gharar. No Muslim can have involvement in any contract where the ownership of property depends on uncertain events. Islamic law regards Gharar as unethical because it is inequitable. One person in the interaction has an advantage in knowledge or resources.

Islamic Finance Halal Loans Sharia Finance Australia

The information we request will vary depending on your personal circumstances and includes documents to support income, deposit or equity, assets, liabilities such as current mortgages, car loans, credit cards etc. When considering an Islamic home you will need to think carefully about what you can afford. Different lenders have different rules about the size of deposit they require from you in comparison to the value of the property they will buy. They also charge rent at different rates once you move in, so you should really speak to several lenders and compare the rates, as well as comparing any fees involved. At the end of this time, the lender will give you the property as a gift.

RMIT senior lecturer of finance Dr Angel Zhong covers meme stock ETFs as well as provides her thoughts on next year’s economic outlook. We acknowledge the Traditional Custodians of the unceded lands and waterways on which Deakin University does business. We pay our deep respect to the Ancestors and Elders of Wadawurrung Country, Gunditjmara Country and Wurundjeri Country. "Sukuk has already been introduced in many international markets and Australia must be quick to take advantage of the opportunities," Dr Azad said.

Your application is subject to the Provider’s terms, conditions and criteria. Anyone can apply for an Islamic mortgage and the application is assessed on your financial circumstances, not your religion . You may find your deal more expensive due to the particular nature of Islamic mortgages and the fact that there aren’t many providers. Although you won’t be paying interest, you’ll be paying more than the selling price in the form of your rental or profit fee. Find out how much the rate is and what your eventual total repayment amount will be.

In issuing sukuk, governments or corporations must list an asset as security. Other countries have used large public assets like ports to back sovereign sukuk programs. The idea is that the infrastructure funded by the Islamic bonds eventually generates enough profits to reimburse the investor the agreed amount. By sending a press release and/or signing up for a subscription of our service Get The Word Out, you agree to the following terms of use, limitations, quality policy and fair use policy. Get The Word Out reserves the right to suspend or delete your account if any of the terms below are believed not to have been adhered to.

This means you’ll need to provide evidence of funds for your deposit, your savings history, employment history as well as information related to any other assets or liabilities you have. The nature of the lease payments depends on the lease structure that is set out by the lessor. The agreement will also set out what happens to your rental payments when market interest rates fluctuate. Generally, it’s not possible in Australia to provide a fixed rental for the entire term of a mortgage. And at the big end of town, one of the country's largest banks, NAB, is launching a specialised financing product for Islamic business customers, which the company believes is an Australian first for banking. Islamic Bank Australia (islamicbank.au) will be the first Australian bank to offer a full suite of retail and business banking services – all without interest and Shariah-compliant for the first time in Australia.

Depending on the financial institution, Islamic home loans may be slightly more expensive than non-Islamic home loans. However, this will depend on how the financial institution determines the profit made on the sale. The fundamental difference between a typical home loan and a Sharia-compliant home loan is in the borrowing terms used (i.e. interest with a typical home loan vs rental or profit fee with an Islamic home loan). The bank has security over the property, which means that if the borrower defaults on their home loan, the lender can enforce a sale of the property to recover the outstanding funds that are owed. "People could pay their bills with us, withdraw at ATMs, have savings with us on a profit-share basis, not interest based." The bank has legal claims to the home, and can repossess and force you to sell it if you default on your loan.

Values Based Organisations As Australia’s first Islamic Bank, we are proud that our products will bring financial inclusion to thousands… Ethical banking is in our DNA; we make ethical decisions in whatever we do. We're a "Restricted ADI" which allows us to build our systems and test our products before 5 July 2024.

A home loan is a musharakah contract in which one party – you – buys the equity share of the other party in instalments until they’ve bought the property in full. Islamic law says that interest can’t be charged or paid on any financial transaction. Even though there’s no interest on the loan, you can still use it to buy land, build a house or buy an existing property. Islamic mortgages aren’t usually used for refinancing a property, though. Meanwhile Islamic Banking Australia – a group of Muslim Australians and industry veterans – have applied for a licence for a digital bank that is totally sharia-compliant.

According to the MCCA, the mortgage can either be seized by the funder or left with the borrower given that it is registered for full mortgage securities entitlement to the funder. It is also permissible to use a third party property as a security mortgage. Murabaha, an Islamic term, is defined as a transaction where the seller discloses the cost of its commodity, then adds some profit thereon, which is either a lump sum or based on a percentage. Michael Bleby covers commercial and residential property, with a focus on housing and finance, construction, design & architecture. Pension funds in Malaysia, Indonesia and Brunei were interested in exposure to Australian residential real estate, through rateable and tradeable securities called sukuk in Islamic finance, Crescent Finance managing director Sayd Farook said. He recently acquired a car, but to avoid buying it through finance, ended up leasing it, which was more expensive and meant he didn’t actually own the vehicle.

Islamic Finance Halal Loans Sharia Finance Australia

Overall, very good customer service and will definitely recommend it. Ultimately, we want to bring our Shariah compliant products to the grass roots of our community and we have leading representatives in each state that can assist you. We have been recognised for our commitment to client service having been awarded the Best Islamic Finance Institution for three consecutive years by the prestigious. The Islamic Finance News awards honour the best in the Islamic finance industry and are one of the most prestigious awards highly recognised by global Islamic finance capital markets. Please read our website terms of use and privacy policy for more information about our services and our approach to privacy. Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product.

Sharia law also prohibits financing pornography, alcohol and gambling. Mr Gillespie said IBA had extended the remit for ethical banking to exclude live animal exports, big polluters and weapons. I recommended all in Australia to take loan from them to buy property. With nestegg, you can get fresh, spot-on information about cryptocurrency, mutual funds, properties, stock market, and other platforms you can use to invest your money effectively.

Islamic-law compliant products involve the financier buying a property and then the customer buying a share over time, by paying rent, rather than being charged interest. Some homebuyers mistakenly think Islamic home loans in Australia just make a superficial effort to comply with Islamic law, but that couldn’t be further from the truth. Often, that’s because they see Sharia-compliant products displayed with an interest rate. Sharia-compliant financiers are bound by Australian regulations to show products in this way. The Australian Securities and Investment Commission demands all financial products be easily comparable, so charges for Islamic home loans get converted to the equivalent of an interest percentage rate for illustrative purposes only.

They must hold an Australian Credit Licence number which identifies them as an institution engaged in legal credit activities. The payment from zakat is used for charitable or religious purposes and is a mandatory process for Muslims in order to physically and spiritually purify any additional earning they have made over the year. Essential tools and tips on everything from buying to investing in property. In some cases, for a licensing fee, our finalists and / or winners may choose to display our award logos in their marketing materials and on their website to promote the quality of the product to the public. Please take an opportunity to read InfoChoice’s Privacy Policy, Terms of Use Policy and Financial Service Guide and Credit Guide . For information on how we've selected these "Sponsored" and "Featured" products click here.

Some of these help you in achieving property ownership sooner, while others can give you the option of lower payments if you make lease payments only. With an Islamic home loan, you can choose the home and then the financial institution will buy it from the seller. This same financial institution then agrees to lease the home for a pre-determined period, which is known as Ijarah Muntahiyah Bittamlik.

They operate more like a rent-to-buy agreement, and no interest ever gets charged or paid. Designed to meet Islamic Law requirements, the product structures financing as a lease where ‘rent’ and ‘service fee’ are paid instead of ‘interest’. The Bank has also invested in achieving the endorsement of Amanie Advisors, a global Shariah advisory firm on behalf of its customers to provide comfort around the law compliancy while saving clients valuable time and money.

Volt said it would hand back its licence and close for depositors last week after failing to attract funding. Sukuk can only be used on ethical investments, not things that are considered haram – forbidden by Islam – for example gambling, alcohol, tobacco, or arms manufacture. This makes it a natural fit for funding green energy projects and a desirable financial product for ethically conscious investors, as well as Islamic investors.

The nature of the lease payments depends on the lease structure that is set out by the lessor. The agreement will also set out what happens to your rental payments when market interest rates fluctuate. Generally, it’s not possible in Australia to provide a fixed rental for the entire term of a mortgage. Islamic home loans enable you to finance your property purchase with a different financial product that doesn't accrue interest in quite the same way. However, Australia’s credit laws still apply and the lender will still charge you for borrowing money.

Shariah-compliant banking

” you’ll find list brokers and providers that specialise in Islamic home loans. ” you’ll find list brokers and providers that specialize in Islamic home loans. However, according to Ernst & Young, Islamic banking assets have experienced rapid growth and are forecast to increase by an average of 19.7% a year until 2018. A number of Australian financial institutions have examined Muslim financing concepts such as profit sharing and rent to buy while trying to avoid terms such as "interest" in contractual agreements. During the Islamic home loan term, things work slightly differently. The homebuyer still makes regular repayments to the finance provider, but part is a pre-agreed fee for the property’s sole use during the loan term.

At the end of the mortgage, the homebuyer owns 100% of their home, and the lender’s involvement is over. Home ownership among Australian Muslims is half that of the national average, but they are just as likely to be chasing the Australian Dream of their own property. Thus, it is a major potential growth market for mortgage brokers, albeit one that has previously been hard to break into. Our shariah-compliant financing solutions are here to help you to meet your property, vehicle or commercial need. I recommended all in Australia to take loan from them to buy property.

Overall, Amanah Islamic Finance is highly recommended for anyone in the market looking for a trusted, Shariah compliant product. Moreover, before you apply for a specific loan, please make sure that you’ve read the relevant T&Cs or PDS of the loan products. You can also check the eligibility requirements to determine whether the product is right for you or not. The financial institution makes money by charging a profit rate on your rental instalments. The providers of this style of finance all operate under the National Consumer Credit Protection Act and will make independent enquiries into your ability to meet the financial commitments without undue hardship.

Similar prohibitions apply to financial products that can gain or lose substantial value, such as derivatives. While there are several foreign banks in Australia, including the Arab Bank and HSBC, few of them offer Islamic home loans. However, Westpac and National Australia Bank have introduced Sharia-compliant products to the market.

Consider the Product Disclosure Statement , Target Market Determination and other applicable product documentation before making a decision to purchase, acquire, invest in or apply for a financial or credit product. Contact the product issuer directly for a copy of the PDS, TMD and other documentation. The requirements to apply for Islamic home finance are similar to those of a traditional mortgage application. Essentially, applicants will need to substantiate their income in order to demonstrate their borrowing capacity, and provide proof of their intended deposit.

The Australian Financial Review

Mozo provides factual information in relation to financial products. While Mozo attempts to make a wide range of products and providers available via its site it may not cover all the options available to you. The information published on Mozo is general in nature only and does not consider your personal objectives, financial situation or particular needs and is not recommending any particular product to you. Mozo is paid by product issuers for clicks on, or applications for, products with Go To Site links. If you decide to apply for a product you will be dealing directly with that provider and not with Mozo. Mozo recommends that you read the relevant PDS or offer documentation before taking up any financial product offer.

When it comes to making our community’s dreams come true, MCCA has a strong track record in delivering excellence. To meet with Islamic law requirements, finance needs to be structured as a lease where rent and service fees are paid instead of interest or some other kind of profit-sharing arrangement. But he said that with Chinese investment on the wane – a market on which Australia has relied in recent years – Islamic finance could offer a way to bridge that gap, and there were many experts to help guide the transition. Despite an increase in bi-lateral relations between Australia and several Islamic nations in recent years, and its own growing Muslim community, Australia is the only western country in the world with no government or corporate backed sukuk market. A sharia-compliant Islamic bond could offer a solution to encourage much-needed foreign investment in green energy projects as Australia works quickly to meet sustainability targets, according to a Deakin University Department of Finance academic. It becomes the first Islamic bank in Australia, with all its banking products endorsed by “prominent Shariah scholars”.

The Islamic Bank Australia will offer banking services that are compliant with Sharia Law to a small number of customers starting in 2023. On Friday NAB will officially launch sharia-compliant loans of over $5 million for commercial property and construction, the first of the Big Four banks to do so. Mr Gillespie has a range of retail banking experience, including as a former head of home loan distribution at CBA and former head of mortgages at Bankwest. Describing Islamic banks as similar to a partnership where both the bank and the customers share the benefits, Mr Gillespie noted that they were also inherently ethical. Make recommendations and findings that will ensure, wherever possible, that Islamic financial products have parity of tax treatment with conventional products. Developed in a mere six weeks, the Shariah-compliant prototype enables any financial institution to enhance their offering and into Islamic banking services through a technology stack that essentially plugs into the infrastructure.

Invest ethically and get Shariah compliant returns as you move one step closer to your goals. For almost a decade, we have been amalgamating wealth with faith to advance ethical economic growth and financial opportunity for all Muslims. Money is a big deal for everyone so we’re here as your money partners, finding the best way to make it happen. 'Mozo sort order' refers to the initial sort order and is not intended in any way to imply that particular products are better than others. You can easily change the sort order of the products displayed on the page. To follow Sharia Law, Islamic Bank Australia will follow a lease-to-buy/co-ownership model that acts like paying a monthly rent until you pay off the equivalent of the property’s original price.

Take our quick Risk Profile Quiz to find the right investment product for you. The term Ijarah is derived from the Arabic language and means “lease”. In terms of financing a property, Ijarah refers to the process in which a financier and client enter into a contract together enabling the client to purchase a property, vehicle or commercial asset in compliance with Islamic Law. Potentially, more information will be released closer to the bank’s opening date around profit sharing.

The home finance product will operate under a co-ownership model, whereby the customer will purchase a portion of the property and the bank will buy the remainder. The customer will then pay the bank rent until they have bought back the remaining equity. Accelerate time-to-market and tap new Islamic banking opportunities with comprehensive product management and flexible workflows. United Bank sets a course to elevate customer experience and expand business for Islamic banking and conventional banking. Customize and attractively price Islamic products and offerings for customers and markets. "The Bahrain Central Bank made a very generous offer today to work with Australian regulators as we boost our readiness for a range of Shariah-compliant products, both wholesale and retail."

Islamic Finance Halal Loans Sharia Finance Australia

Switch your Self Managed Super to ICFAL and join a fund of $50 million+ that provides Shariah compliant returns on its investments. Be part of a 4000+ member strong community that finances projects and ambitions through Islamic contracts. Terms, conditions, exclusions, limits and sub-limits may apply to any of the insurance products shown on the Mozo website. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider's website for further information before making any decisions about an insurance product.

For savings accounts, banks pool depositors’ funds and use them for ethical profit-producing activities, and then shares these profits generated with the customer – like a partnership between the depositor and the bank. The original deposit amount will be guaranteed, but the actual profit returned over the term may vary. While the bank is not yet open for business , it has said it will offer a full suite of shariah-compliant retail and business banking services.

As a marketplace business, we do earn money from advertising and this page features products with Go To Site links and/or other paid links where the provider pays us a fee if you go to their site from ours, or you take out a product with them. The Islamic Bank Australia will offer banking services that are compliant with Sharia Law to a small number of customers starting in 2023. On Friday NAB will officially launch sharia-compliant loans of over $5 million for commercial property and construction, the first of the Big Four banks to do so. While Islamic Bank Australia is not yet open for business, the restricted ADI enables it to build and test systems and then offer products to a small number of real customers. The Board requested written submissions on the review of the taxation treatment of Islamic finance products by 17 December 2010.

Yet, despite making an Australian gastronomic icon, over the years the small business owner has felt excluded from the country's financial system and investment opportunities. This attracts double stamp duty too, and was one area looked at by the taxation review that Asad participated in. But after the couple married in 2018, they started using an Islamic financing company to buy property.

The cost will include the rental amount plus payment towards buying the bank’s ownership of the property. The typical Australian home loan earns a certain amount of interest annually. That interest is the profit the financial institution makes when you borrow its money. There are hundreds of deposit-taking banks around the world that are Sharia-compliant.

"We've done $100 million in loans, just in the past six months," Hejaz's chief executive Hakan Ozyon says. Despite recognising it could be worth $250 billion, a recent report found Australia's Islamic finance industry was indeed still in its infancy, options for consumers were still limited and of varying quality, and regulatory barriers were present. "So a lot of these investors, as the industry has developed, will be looking to diversify their funds and look for alternative investment location. Australia is well placed in all of that."

The most powerful knowledgebase mapped from 20 years of research and insight into every WA leader and business. For more business news and analysis, visit NAB’s Business Research and Insights. NAB has cut fixed home loan interest rates for its four-year term to the lowest level in more than 20 years, giving borrowers value and certainty. National Australia Bank today announced that it has invoked its disaster relief package for customers impacted by bushfires in the Perth Hills area of Western Australia. The Assistant Treasurer also visited Deloitte's Islamic Finance Knowledge Centre in Bahrain and addressed a national roundtable of key figures from the Islamic finance industry in the Gulf region.

Describing Islamic banks as similar to a partnership where both the bank and the customers share the benefits, Mr Gillespie noted that they were also inherently ethical. If you open a savings account with us, we’ll use your funds in ethical income-generating activities, and then share these profits with you. It’s a totally new way to think about banking,” explained Mr Gillespie. Home finance is based around co-ownership, with the bank charging rent to the customers when they are living as a tenant in the bank’s share of the property . Islamic finance is based on a belief that money should not have any value itself, with transactions within an Islamic banking system needing to be compliant with shariah . Interest-based home loans that dominate our market generally allow people to borrow money from a bank, buy a house with that cash, and then pay the money back over a fixed term to the financier with interest.

Australias leading Islamic finance and investments

Over the course of the financing period, you purchase the ownership of the house at regular predetermined intervals along with rental payments. Canstar is a comparison website, not a product issuer, so it’s important to check any product information directly with the provider. Consider the Product Disclosure Statement , Target Market Determination and other applicable product documentation before making a decision to purchase, acquire, invest in or apply for a financial or credit product. Contact the product issuer directly for a copy of the PDS, TMD and other documentation.

Islamic home loans are different to the mortgages offered by most banks. Learn more about Islamic home loans, including how they work and what to look for. You can also compare other home loans and get a better idea of their costs and benefits. With the Diminishing Musharaka model, ICFAL joins you as a partner in owning the house you desire.

Mr Zoabi said a block of 25 apartments in Huskisson on the south coast of NSW – all of which had been sold – had been waiting to be developed. The developer did not have all the equity but did not want an interest-accumulating loan due to their faith. More than 30 years later Australia – with a Muslim population of about 1.2 million – is beginning to open up to the untapped Islamic finance market, estimated by global researcher Salaam Gateway to be worth $248 billion. “Interest-free banking was non-existent in Australia, but it did exist in Canada where I had previously been studying,” he said. 'Mozo sort order' refers to the initial sort order and is not intended in any way to imply that particular products are better than others.

Depending on the financial institution, Islamic home loans may be slightly more expensive than non-Islamic home loans. However, this will depend on how the financial institution determines the profit made on the sale. No, there is no restriction on non-Muslims taking out Sharia-compliant home loans; however, as there is no financial benefit to non-Muslims, it's not often an option offered to them. Murphy stresses that when comparing Islamic home loans, you should keep an eye out for the service level offered by the provider.

Construction company Binah said the NAB’s sharia-compliant finance meant it could take on projects with development partners and fund them while maintaining core values of their faith. When Professor Ishaq Bhatti came to Australia 30 years ago, the bank teller looked bemused when he asked for a savings account that didn’t accrue interest. When Professor Ishaq Bhatti moved to Australia to do his PhD in 1987 he went to the bank and explained he was a Muslim and needed a savings account that didn’t accrue interest. Potentially, more information will be released closer to the bank’s opening date around profit sharing. In Australia’s banking system, interest is implemented everywhere, making it difficult for the 3.2% of Australians identifying as Muslims to follow their own laws.

The offer includes employment at NAB and has an aim of improving the bank's understanding of Islamic banking. "At the moment, there isn't a great awareness about Islamic banking in the Muslim community," he says. "Once you have those resources and services, word will spread, branches will open up in every city and a domino effect will start." "I'm not sure why the mere usage of the world 'interest' can cause a conflict between Sharia and Aussie law," he says. The MCCA and other Islamic finance lenders often define the amount of money they take above the purchase price as profit. Since "interest" is forbidden, the word is avoided in most cases, although the Australian government still requires it to be used in the paperwork.

These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider's website for further information before making any decisions about an insurance product. The Islamic Bank Australia will offer banking services that are compliant with Sharia Law to a small number of customers starting in 2023. All fees are negotiated with institutions on a case by case basis and may vary between products and providers. Some institutions apply annual account management fees that can bump up the cost of your monthly payments, so look for deals with low or no fees.

The more funds you repay, the more ownership you have in the property until it is paid off in full. Keep in mind that just because the institution doesn’t charge interest, doesn’t mean it doesn't charge a profit. The financial institution still makes a profit from leasing the property to you. However, according to Ernst & Young, Islamic banking assets have experienced rapid growth and are forecast to increase by an average of 19.7% a year until 2018. A number of Australian financial institutions have examined Muslim financing concepts such as profit sharing and rent to buy while trying to avoid terms such as "interest" in contractual agreements.

"We expect Australia to license online-based Islamic finance in 2021. Then we will really understand the demand for Islamic finance in Australia," he said. Dr Tanmoy Choudhury, a lecturer at Edith Cowan University in Perth, said the size of Islamic banking in Australia is at least AUD 2.5 billion. "I tell my students that resharing is critical for equitable economic growth in a country. Since the fundamentals of Islamic finance are based on resharing, interest from Western stakeholders is growing," he said. Of course, the concept of Islamic banking is gaining importance in Muslim-majority countries, even in many developed countries in the West, and Dr. Hassan is very optimistic about its future success. "But in the Qur'an, Allah has made business lawful. Interest is forbidden not only in Islam, but in all Abrahamic religions, such as Christianity and Judaism," he said. "On the other hand, there is no harm in financial transaction in Islam, but there should be no extra charge. This is what Allah has declared forbidden in the Holy Qur'an."

Ingen kommentarer endnu